We hope you’re having a festive holiday season! Here at MARKETview we are busy Decking Our Halls With Data and unwrapping new deposit insights for our partners. In this post, we’ll be sharing a very early read on net deposit behavior.

Here are four trends we are seeing from the MARKETview data set (as of December 15).

1. Volume Increases Are Beginning to Snowball (but It’s Still Early)

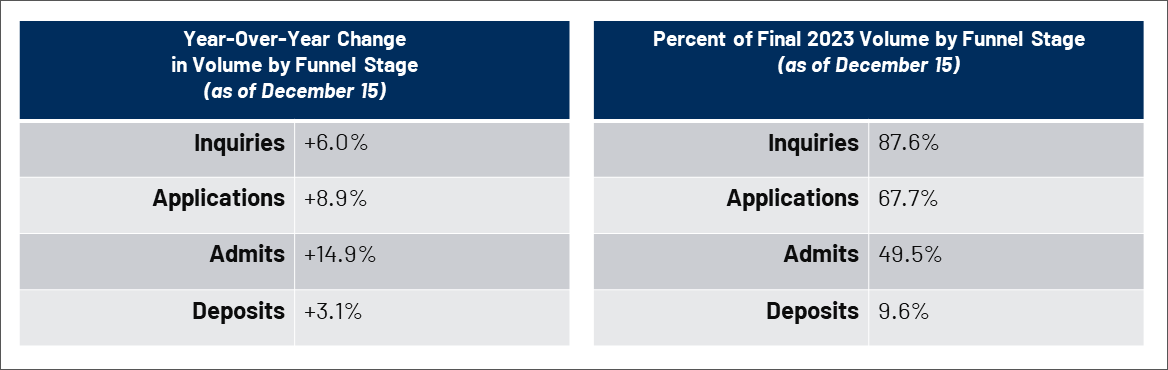

We’re seeing volume increases year-over-year throughout every stage of the funnel. Inquiries are up 6.0%, as are applications (8.9%), admits (14.8%), and deposits (3.1%).

While these metrics would seem to be cause for celebration, we’re still very early into the cycle. The data so far only represents 9.6% of last year’s total deposit volume in MARKETview. For reference, we’ve captured 87.6% of last year’s inquiries in our data set, so there’s still room for growth at all stages of the funnel.

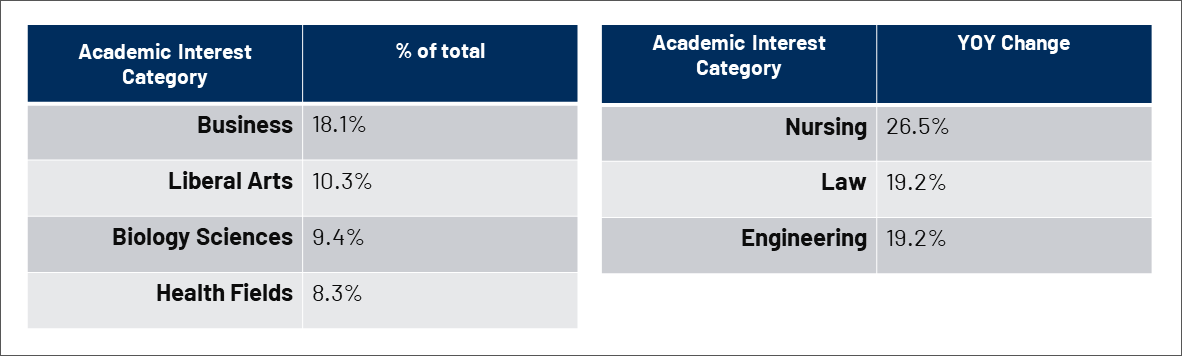

2. Among Academic Interests, Bells Are Ringing for Business and Nursing

Across all academic interest categories in MARKETview, Business represents the largest proportion of deposits with 18.1% of total volume, likely reflecting Generation Z’s growing preference towards academic programs with a strong return on investment. Year-over-year, we are seeing a 26.5% increase in Nursing, which suggests that a chilled interest may be thawing to pre-pandemic levels. We will be monitoring this trend as we collect more data on deposit behavior throughout the cycle.

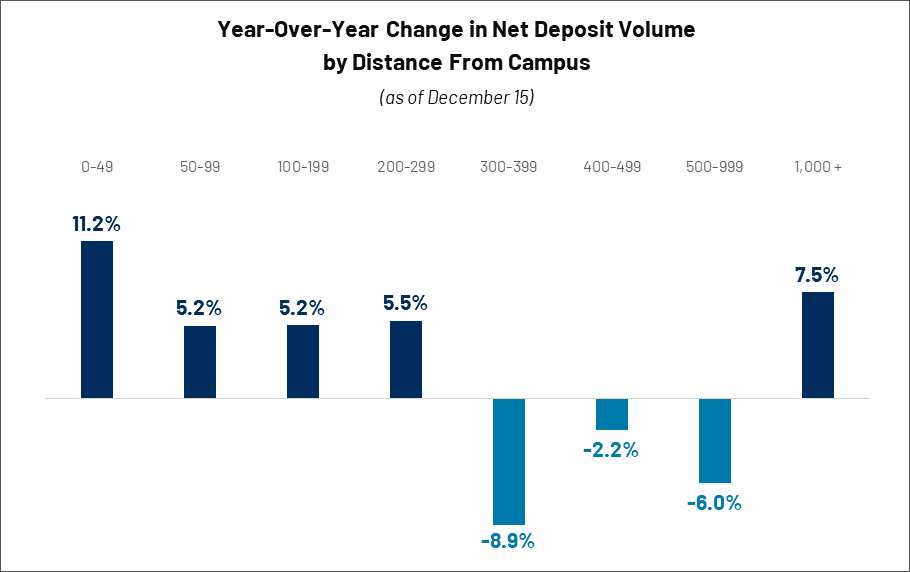

3. Staying Close to Home Is Popular This Season (Though Some Are Electing to Travel Far)

Looking at the year-over-year change in net deposit volume by distance from campus, we see increases for students traveling under 300 miles from home, with the sharpest increase of 11.2% for those within 0-49 miles from home. Deposits are also up for students within 50-99 miles (5.2%), 100-199 miles (5.2%), and 200-299 miles (5.5%). Conversely, we’ve seen a sharp decline for those within the 300-399 range, with deposits down 8.9% as well as decreases for other distances up to 999 miles from home. Interestingly, a proportion of students will be taking a long sleigh ride to school as deposits are up 7.5% for those traveling 1,000+ miles.

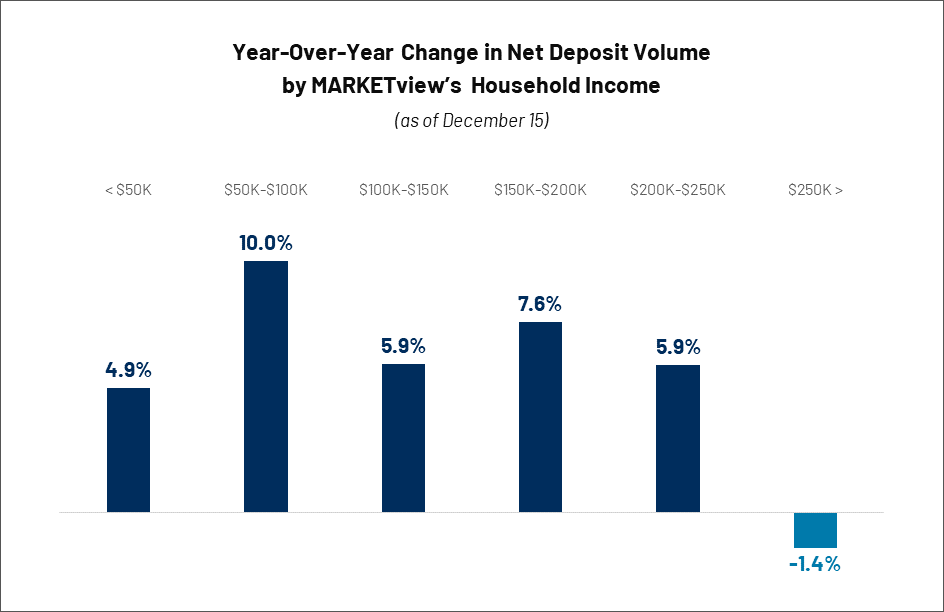

4. Net Deposit Volume Trends Shine Bright for Every Household Except the Most Affluent

Across nearly all household income bands, net deposit volume is up, with the sharpest increases at $50-100k (+10.0%) and $150-200k (+7.6%). Growth from the <$50k income band (a population highly likely to qualify for Pell) should strike a merry note with an increase of 4.9%, despite aid packages being delayed by this year’s FAFSA release. Households with $250k or more sit at a frosty -1.4%, suggesting that the most affluent students have more schools on their wish list and are waiting to consider all their options before making a commitment.

We wish you joy and hope you find these insights encouraging as we wind down an eventful 2023!

We would love to learn about your goals and share more gifts of market context with your institution.