For the past year, MARKETview has been monitoring the data behind the “Covid Class” — the entering class of 2023, whose entire college search journey has been influenced by the pandemic. In our latest and final post of the series, we are going to discuss trends and insights from the deposit stage. See our other insights from previous stages of the funnel: Inquiries, Applicants, and Admits.

Below are four insights about deposit behavior:

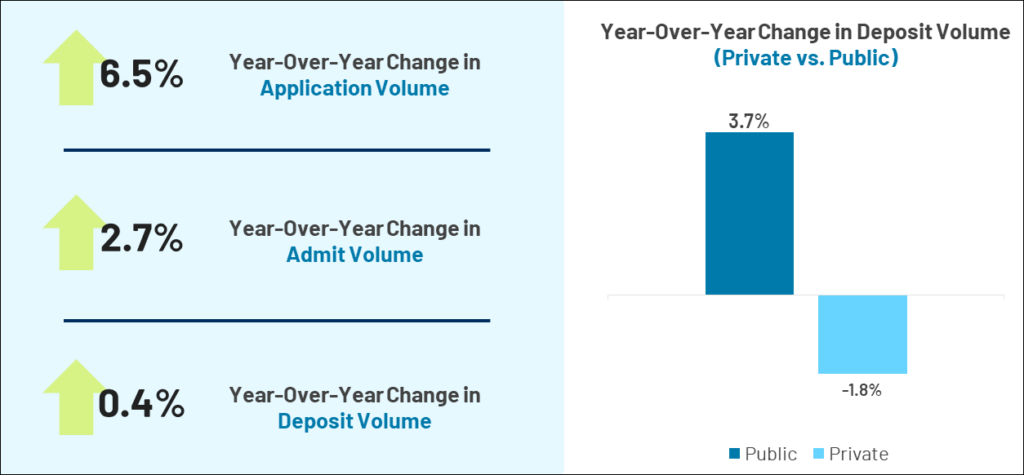

1. While Deposit Activity Was Flat Across the Market, Private and Public Institutions Had Very Different Outcomes

For the Entering Class of 2023 we saw a relatively flat deposit pool, with a total increase of deposit volume of .4% across the MARKETview partner base. This was despite a noticeable increase in both applications and admitted students: across the marketplace there were 6.5% more applications, and 2.7% more offers of admission.

Though deposits were flat in the market, public and private institutions had very different outcomes. Public partners saw an increase in deposits of 3.7%, while private partners saw a loss of overall deposit volume with –1.8% fewer deposits than in 2022, reflecting an increasingly challenging marketplace for private institutions.

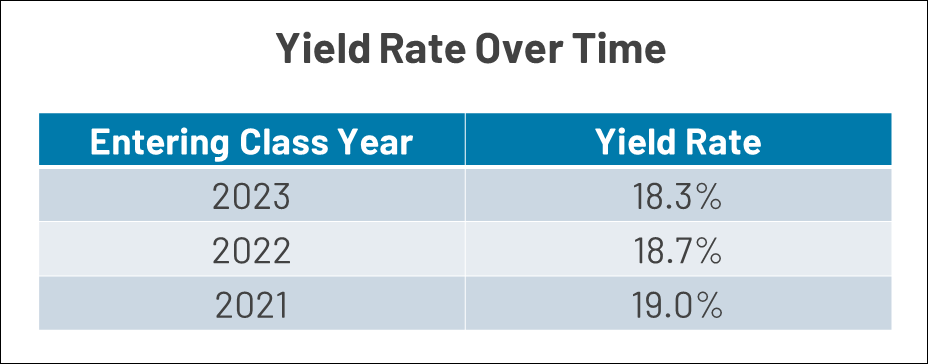

2. Yield Rates Continued to Decline Across the Market

A continued decline in yield across the market has been a large driver of the relatively flat deposit pool we have observed. Across all MARKETview partners yield declined 0.4 percentage points, from 18.7% in 2022 to 18.3% in 2023. Compared to 2021, yield rates are down 0.7 percentage points. Yield declined across both public and private partners. While disappointing, the continued erosion of yield rates is not especially surprising considering the continued growth of first source (stealth) applicants, the rise in Common App applications, and challenges in generating early engagement to build the inquiry pool.

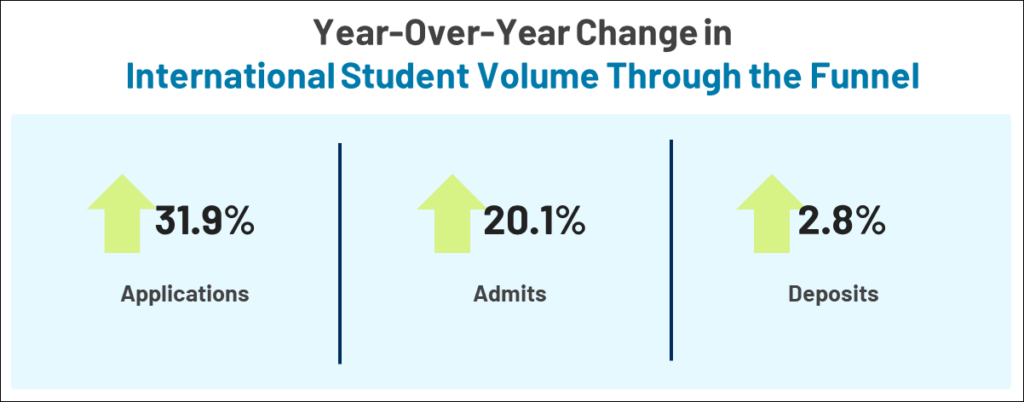

3. Increased International Application Activity Did Not Produce Any Meaningful Deposit Growth

One disappointing trend for the Entering Class of 2023 was the very modest increase in deposits from international students. Overall, MARKETview partners saw a growth of only 2.8% in international deposits—despite seeing 31.9% more applications and offering admission to 20.1% more international students.

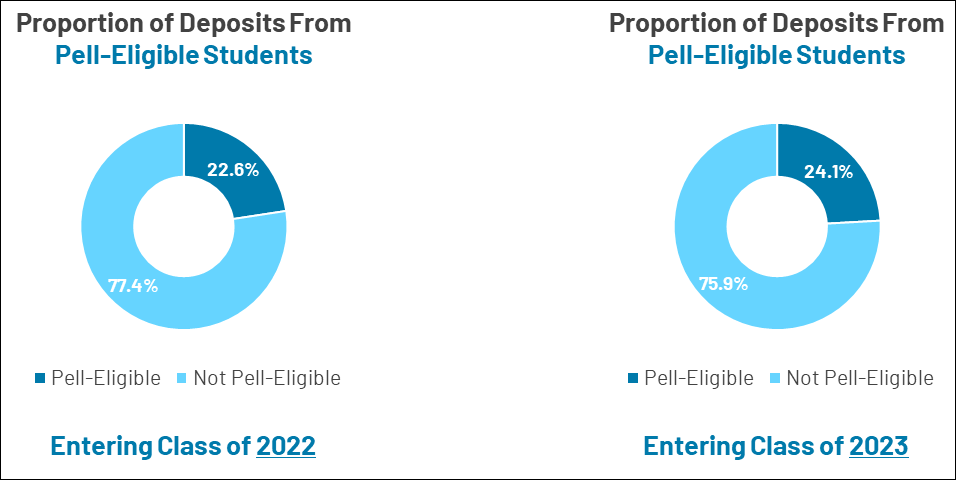

4. A Greater Share of Deposits Came From Pell-Eligible Students

Across the marketplace, we saw a change in the proportion of total deposits coming from Pell-eligible students. For the Entering Class of 2022, these students made up 22.6% of all deposits, and for the Entering Class of 2023, this has risen to 24.1%.

As the the population of likely Pell students continues to grow, MARKETview partners have a competitive advantage—we can help them identify and connect with this population much earlier during the cycle.

Interested in Learning More?

Want to discuss any of these trends in further detail or get a sneak peek at how your institution compares to national trends or your peers’ performance?