As universities across the nation continue to sail through unprecedented headwinds of uncertainty while they wait for delayed financial aid information, MARKETview is already providing our partners with important market context so they can make decisions in the months ahead. One way we’re doing that is through our financial aid services, which offer greater insight (via real-time reporting) into what’s happening across the higher ed landscape—both for students who have filed for aid and those who have not, so schools can deploy the best strategies to achieve their goals.

As we wait for updates from the Department of Education, here are four trends we are certain about this cycle as of February 1.

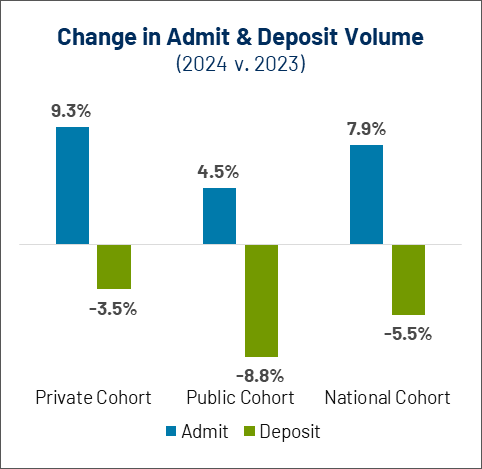

1. Admits are up across the board while deposits lag behind.

These contrasting volumes should come as no surprise as many students are still waiting for their aid packages before they decide which school to attend. While a -5.5% drop in deposits point-in-time compared to last year feels discouraging, there are still reasons to be optimistic as admits are up 9.3% for private schools and 4.5% for publics.

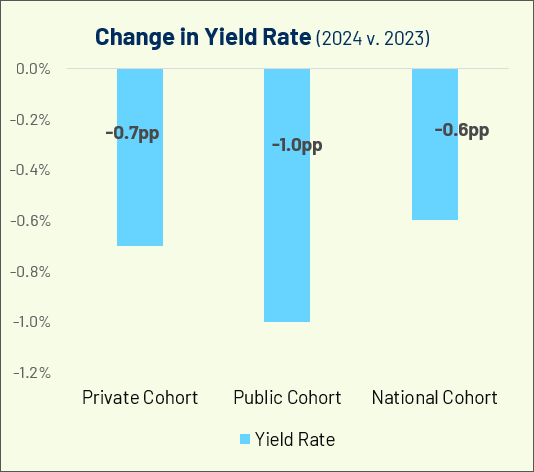

2. Yield rates are down.

With deposits down -3.5% for privates and -8.8% for publics, the change in yield rate is also down -0.6 percentage points for all schools. While this is a disappointing trend, it’s also universal. For schools that are trailing behind the market in yield rate, this may be a moment to ask if there may be other factors influencing the decrease.

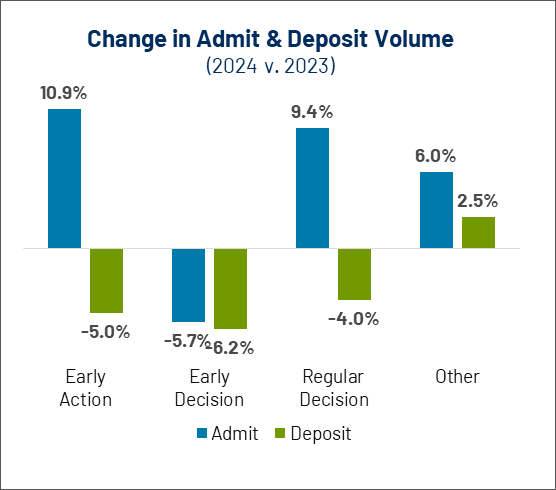

3. Private institutions are down in deposit volume for most decision rounds.

For private institutions, we see a much clearer picture of student activity when we look at admit and deposit activity by decision round. Early Action admits are up 10.9% while deposits remain down -5.0%. For Early Decision, both admits (-5.7%) and deposits (-6.2%) are down compared to last year. Regular Decision admits were up 9.4% but deposits still lag at -4.0%. For “Other” decision rounds, there is some encouraging news, though it’s important to note that this segment accounts for less than 2% of our total deposit volume as of now.

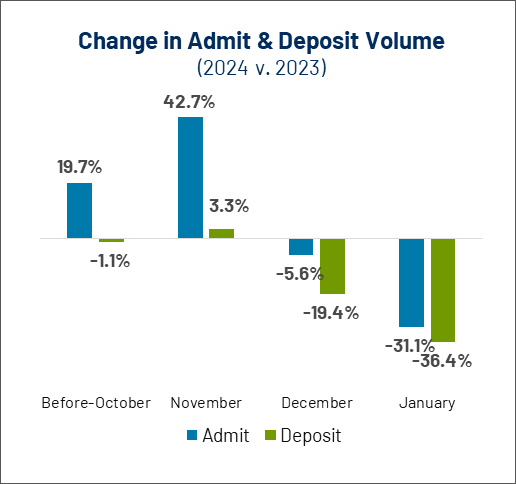

4. Public institutions started hot but have since cooled.

While a low volume of acceptances were officially out prior to November, the cycle began at a rocket’s pace being up 19.7% and 42.7% in admits pre-October and November, respectively. Pacing for admits has come down since the beginning of 2024 with a -5.6% decrease in December and a significant -31.1% drop in January. Deposits remained flat at the beginning of the year but fell -19.4% in December and -36.4% in January.

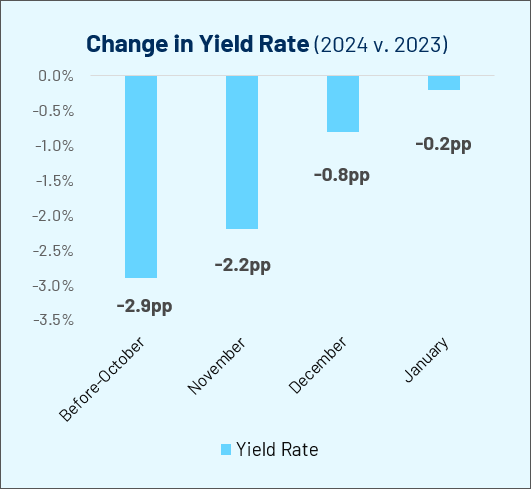

Yield rates have also been down every month this cycle but may have evened out, experiencing just a -0.2pp drop in January, compared to the -2.99pp drop before October of 2023.

While these trends are certainly concerning for schools, we should reiterate that the market forces driving them are universal. If your school is pacing below its projected benchmarks, consider speaking with us about how we can help you reach your goals this year.

Webinar

The Disrupted State of Higher Ed: How College Presidents Are Confronting Change

Learn how the presidents from two institutions are addressing and overcoming a variety of disrupting factors across higher education.