Trying to predict student application behavior can be a moving target, one which you cannot afford to miss if you’re a selective institution in a competitive market. Understanding decision round preferences is an incredibly critical part of this; especially for schools that build their classes with Early Decision (ED) and Early Action (EA) students (or are considering adopting these programs). That’s why we’re accessing MARKETview’s real-time decision round data (as of Oct. 15) to uncover when students are applying to selective institutions and identify potential opportunities for new enrollment investments.

Top 50 Private

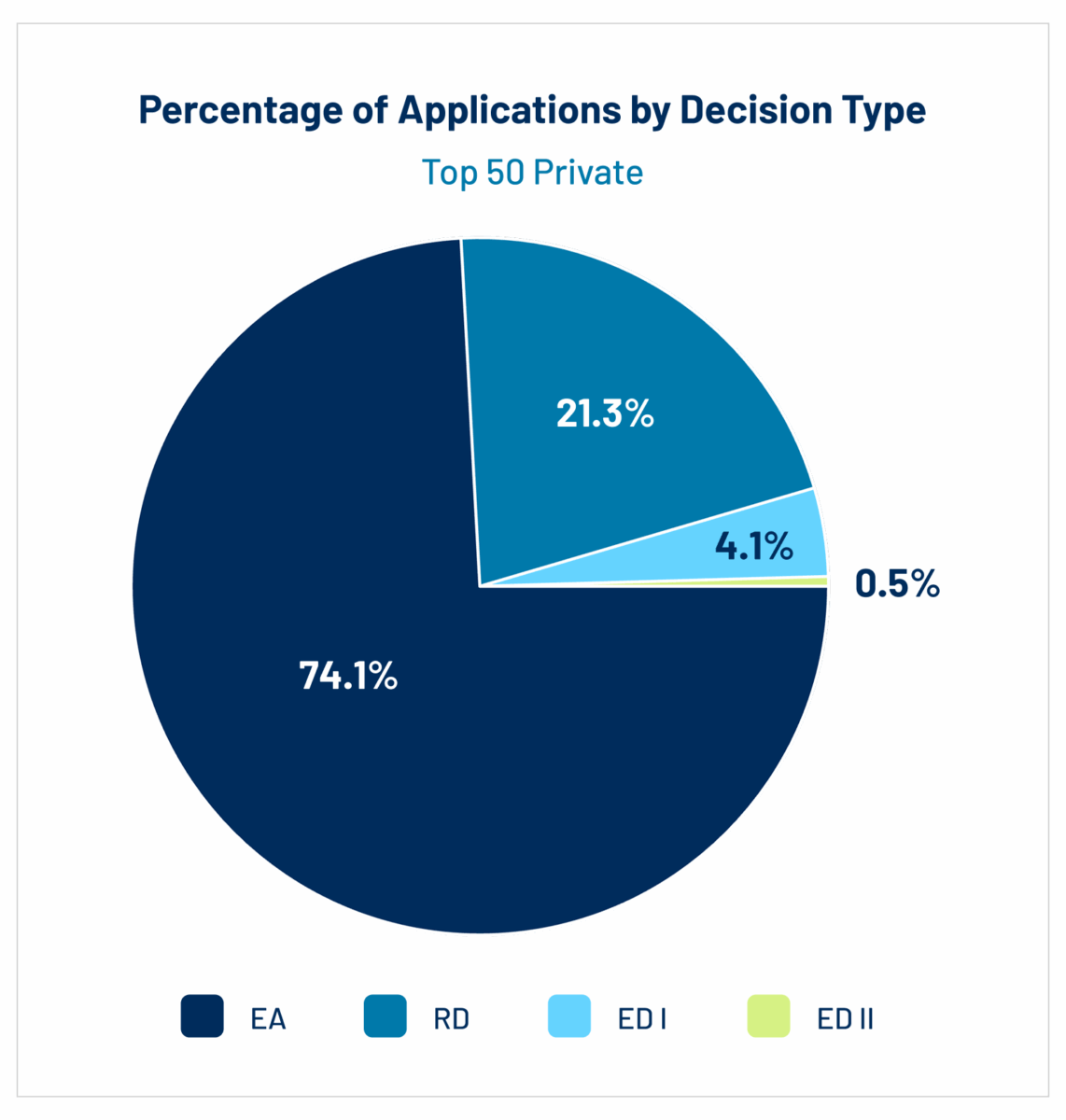

The most elite private institutions are seeing modest growth so far; applications are up by 6.43% Year-over-year (YOY). When breaking down applications by decision type, it becomes clear that these institutions leaned heavily into EA to recruit this year’s class. Of the total applicants for this cohort, 74.1% were EA, 4.08% ED I, 0.45% ED II and 21.3% Regular Decision (RD).

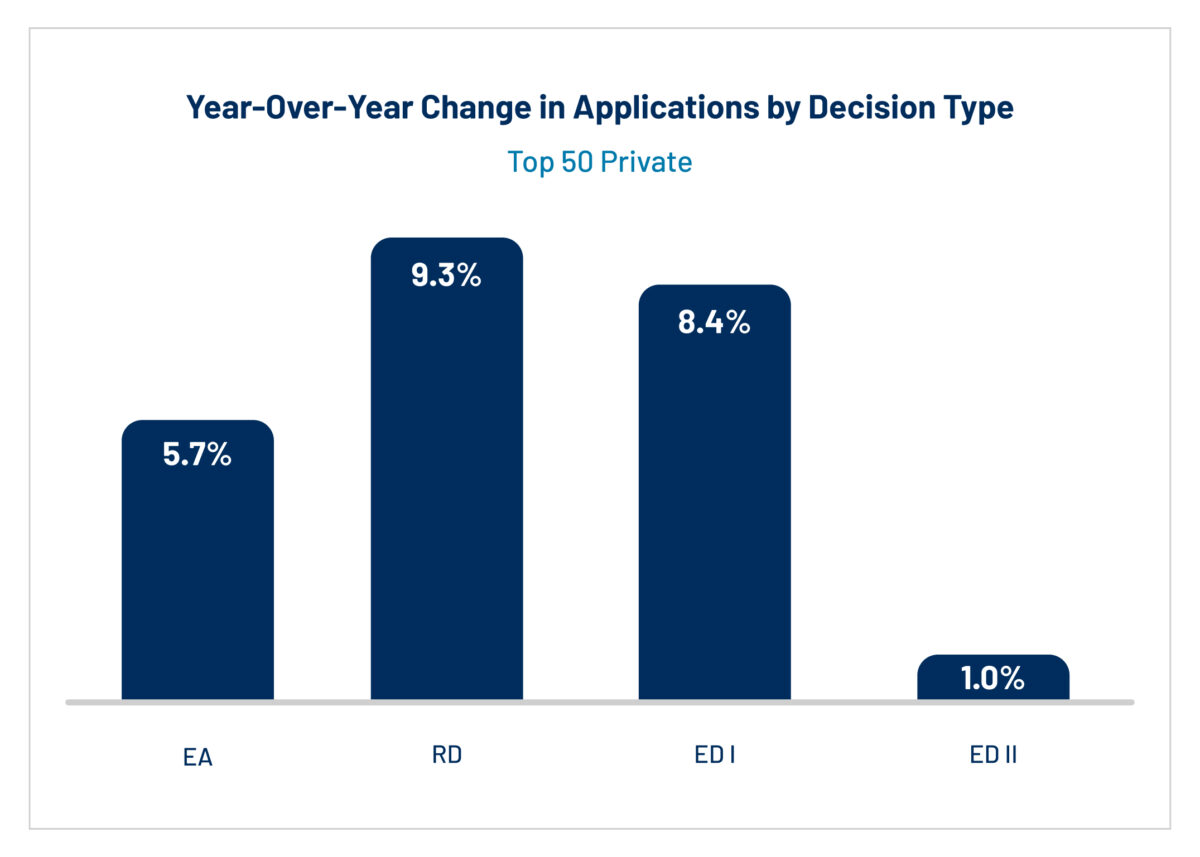

This application success amongst the top private colleges was spread relatively even across all decision rounds. Year-over-year, ED I is up 8.38%, ED II is up 1.02%, EA is up 5.69% and RD is up 9.30%. So far, it seems like outsized investments in Early Action are paying off for the Top 50 Private colleges.

Top 50 Liberal Arts

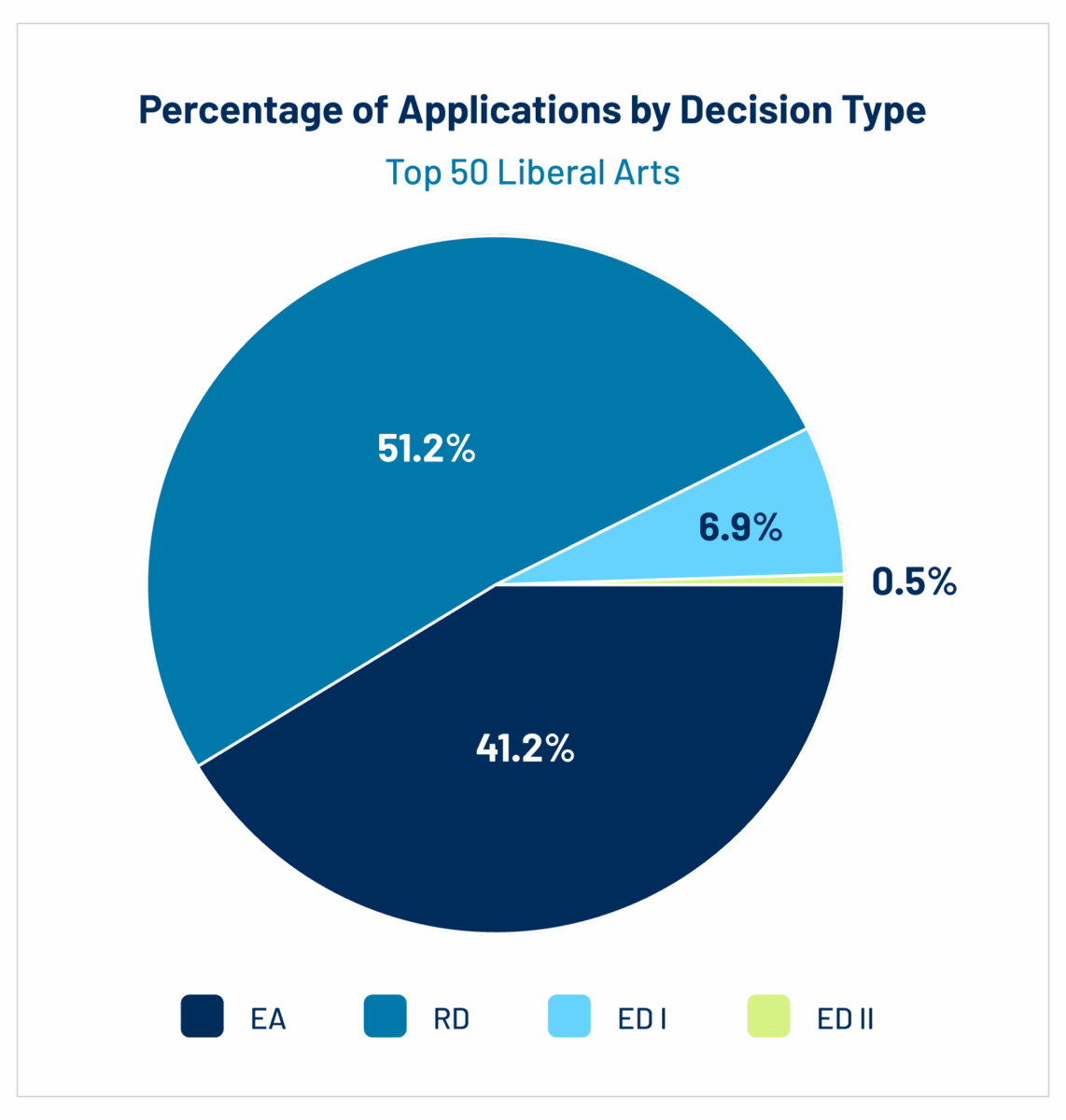

When the Top 50 Private cohort is broken down by school type, it’s clear the Top 50 Liberal Arts schools are off to a slower start than the overall selective private group; domestic applications are down 0.20% YOY. Additionally, these institutions had a much more even split between EA and RD (41.2% and 51.2% respectively) than the broader selective private group, while ED numbers were similar across the board (6.85% ED I, 0.49% ED II).

Examining the YOY change in applications between each decision type reveals where there may be room for improvement within this cohort. Early Decision I is down 13.9%, ED II is down 37.3%, EA is down 9.37%, while RD is up by 13.0%.

There is a notable disparity between selective liberal arts and private institutions’ application growth and a large difference in the composition of both application pools (mainly with EA applicants). This may indicate a strong opportunity for investment in EA recruitment for the most elite liberal arts schools, enabling them to emulate the Top 50 Private schools’ success so far this cycle.

We can see how shifts in student application preferences can have a sizable impact on overall recruitment success. In today’s high-stakes enrollment environment, having the ability to quickly pivot your strategy can be the difference between keeping up with the market or getting left behind. MARKETview’s real-time, comparative data set enables you to monitor the performance of your application pool, providing insight into how student behavior is changing throughout the cycle.

Chat with our team to see how MARKETview’s real-time data can keep you in the know throughout the enrollment cycle on the student populations that matter most to your goals.