As enrollment professionals remain consumed with monitoring the progress of their incoming class, MARKETview is happy to provide this quick snapshot of the most recent yield data. For comparison purposes, we’ve chosen to show how multiple school cohorts are performing as of March 1.

Early Decision and Early Action Experiencing Suppressed Yield.

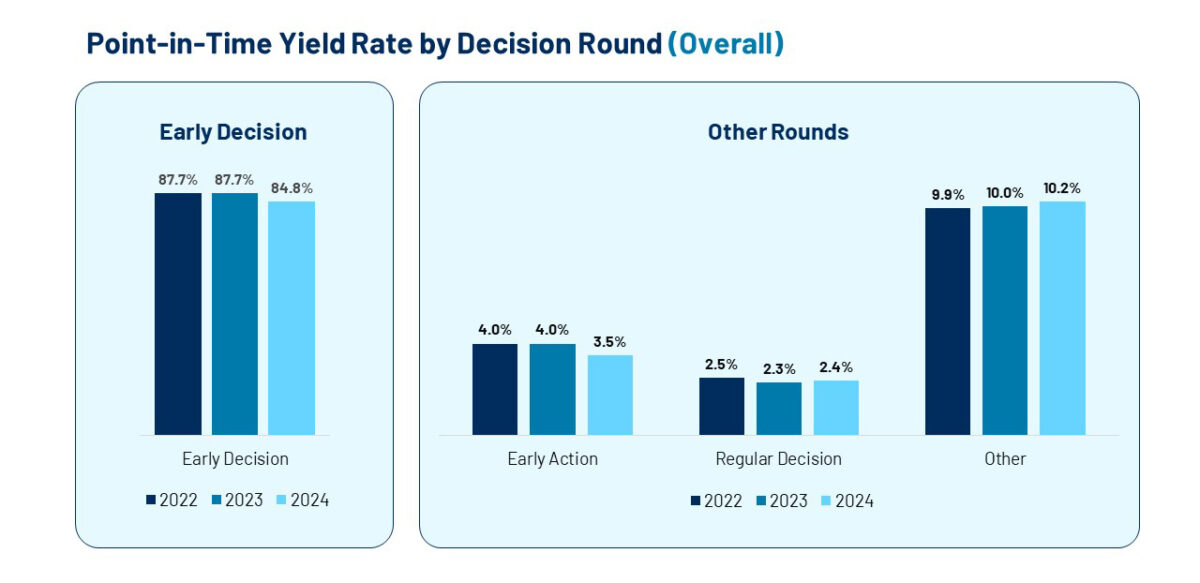

These graphs provide year-over-year-over-year yield rate comparisons by decision round across all MARKETview partners.

You can see that both Early Decision and Early Action are experiencing drops in yield this cycle, which may be attributable to the FAFSA delays and students being reticent to commit with aid amounts unknown. Alternatively, Regular Decision and Other/Rolling Decision rounds are showing modest increases in yield compared to previous years. However, it’s important to note that a subset of MARKETview partners have yet to release Regular Decision, so it is too early to have a firm read on performance for this round. Additionally, while point-in-time yield is slightly up for Other/Rolling, admit volume and net deposit volume are both trailing year-over-year.

In the next couple of graphs, we’ll zoom in on Private and Public cohort activity for a more fulsome picture.

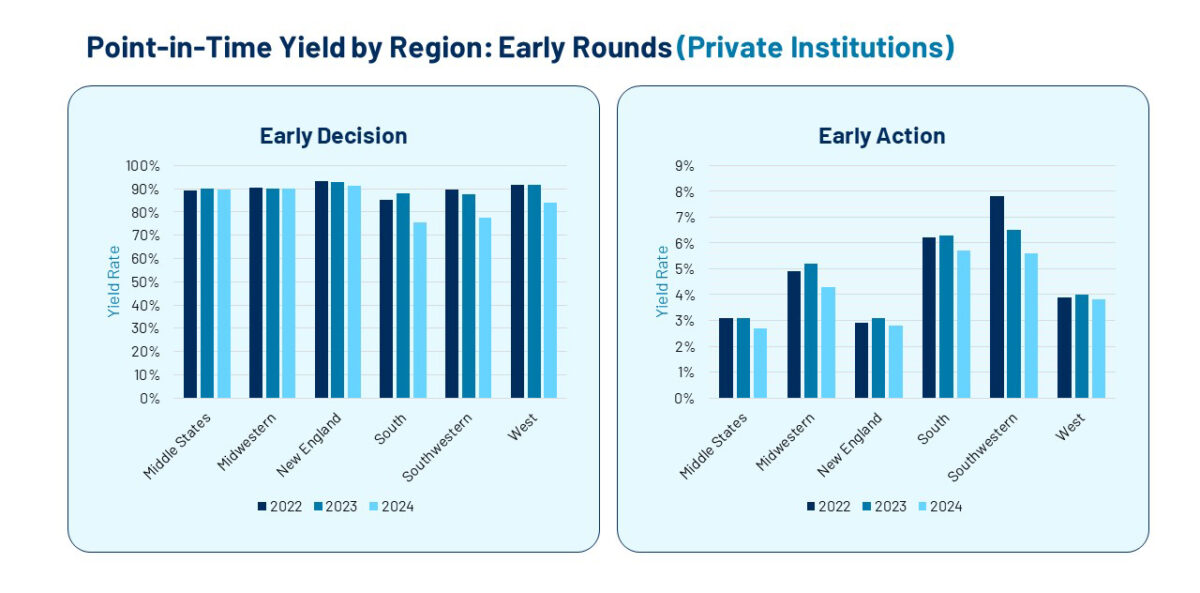

Early Action Declines Span All Regions. Early Decision Rounds Show Less Variability.

When viewing the Private Cohort’s yield rate by region, please note that the data is based on where students live, not where schools are located. From that standpoint, Early Decision is showing the most significant yield deficits among students in the South, Southwest, and West, while the other three regions are holding relatively steady.

For Early Action, we see the yield rate trending down across all regions, with only New England and the West showing minimal drop off compared to years past.

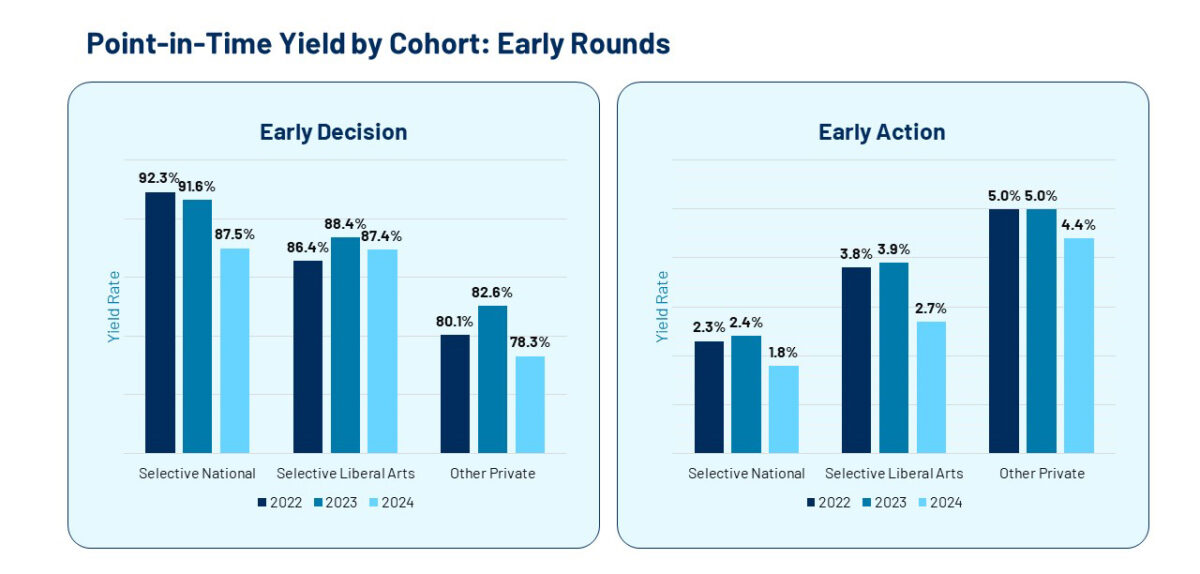

Even Amongst Selective Institutions, Early Rounds Present Challenges.

For a more expansive view of the higher-ed landscape, we’ve broken things out by three additional cohort views: Selective National (Top 100 – U.S. News & World Report), Selective Liberal Arts (Top 100 Liberal Arts – U.S. News & World Report), and Other Private. The concerning yield drops we’re seeing in Early Decision and Early Action are present across each grouping, regardless of selectivity. Within Early Decision, the Selective National and Other Private Cohorts are showing the sharpest declines. While the Selective Liberal Arts Cohort has the smallest drop in Early Decision yield, it is showing the largest drop in Early Action yield.

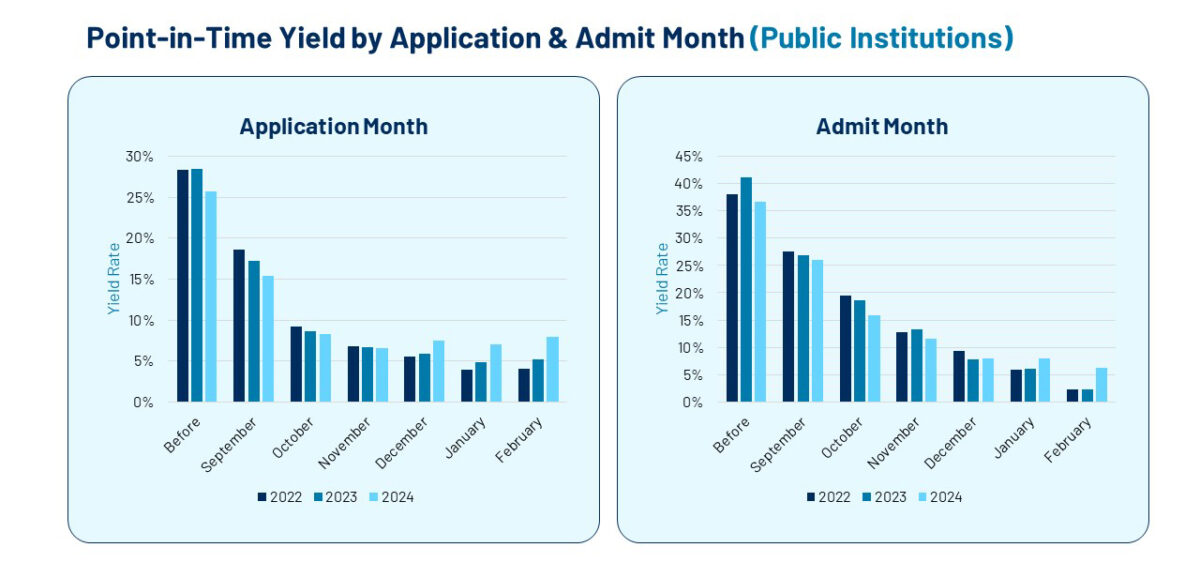

For Public Institutions, Early Applicants and Admits Trail Significantly in Yield.

Knowing that a good number of public institutions either have a single deadline or use rolling admissions, we feel that measuring when a student applies and when a student is admitted provides a clearer picture of the Public Cohort. Generally, students who apply and are admitted sooner yield better. However, public institutions are showing a drop in yield this year from these early movers. What’s also particularly striking is that right now, we’re seeing higher-than-expected yield from those who apply later and are admitted later.

So, for public institutions, students who applied and admitted more recently is where we’re seeing some upward trajectory. This is an important change in student behavior that we’ll continue to monitor and report back on.

Keep in mind that (for largely FAFSA-related reasons) this spring will likely have very different characteristics compared to previous enrollment cycles. Please be sure to check back often for the latest insights and updates.