Lacking its usual finality, May 1 wasn’t the entering-class bellwether that colleges have come to expect. So, what were the takeaways from this normally hallowed date in higher ed? Let’s find out.

After using data as of May 3 from MARKETview’s 150+ college and university partners, we’ll touch on a few chapters in the story of this year’s cycle. If you find this content helpful, we encourage you to check out the more comprehensive findings revealed in our recent webinar, Post-May 1 Insights: The Latest Data on a Still-Unfinished Yield Season.

Post-May 1 Insights: The Latest Data on a Still-Unfinished Yield Season

Discover how deposit behavior has changed leading up to May 1 … and what promise deadline extensions may hold for institutions in the weeks to come.

View the Webinar

Storyline 1: Positive Takeaways

Everyone understands that multiple FAFSA delays are negatively affecting traditional yield metrics. Therefore, we’d like to flip the script a bit and lead off with a few positive indicators at the application stage.

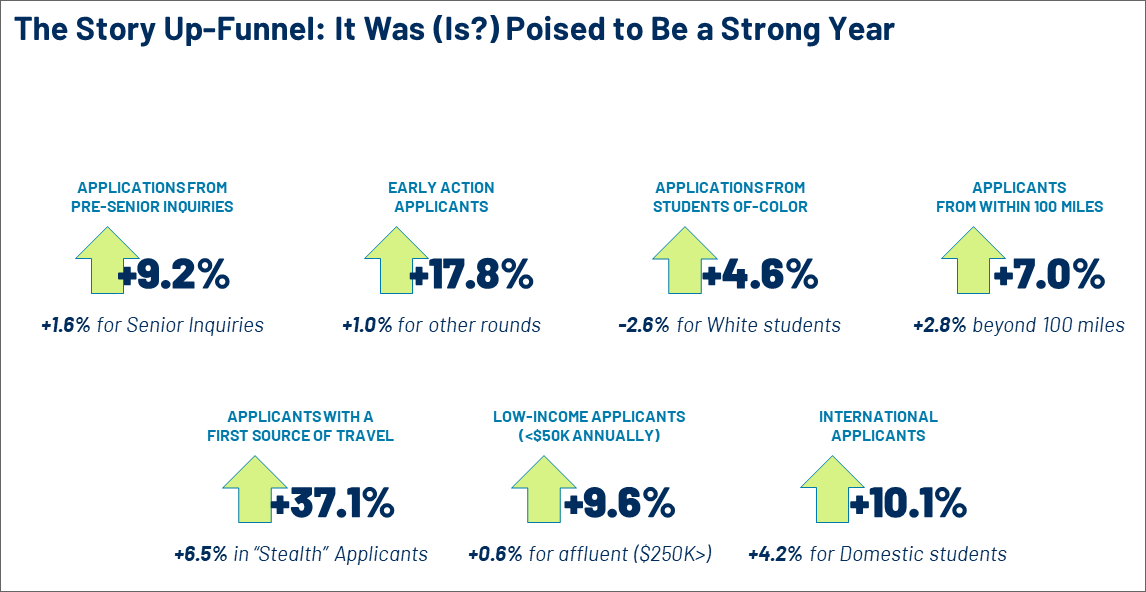

As you can see, several application groups showed impressive growth, including:

- The Early-Action round was flooded this year with applications up 17.8% – a result reflective of a more global migration we’ve seen of students choosing to apply in earlier rounds. It is a bit ironic, though, that in a year when many students still don’t have aid awards in hand, they were originally interested in understanding their options sooner.

- Travel is back! Applications from students with a first source of travel (students met during college fairs and high school visits) were up dramatically at 37.1%. This group makes up a relatively small percentage (~4%) of final enrollments, but they yield at fairly strong rates.

- Applications from two priority audiences for many institutions (Students of Color and Low-Income Households) were up 4.6% and 9.6% respectively.

Storyline 2: The Private Cohort Is Feeling More Heat

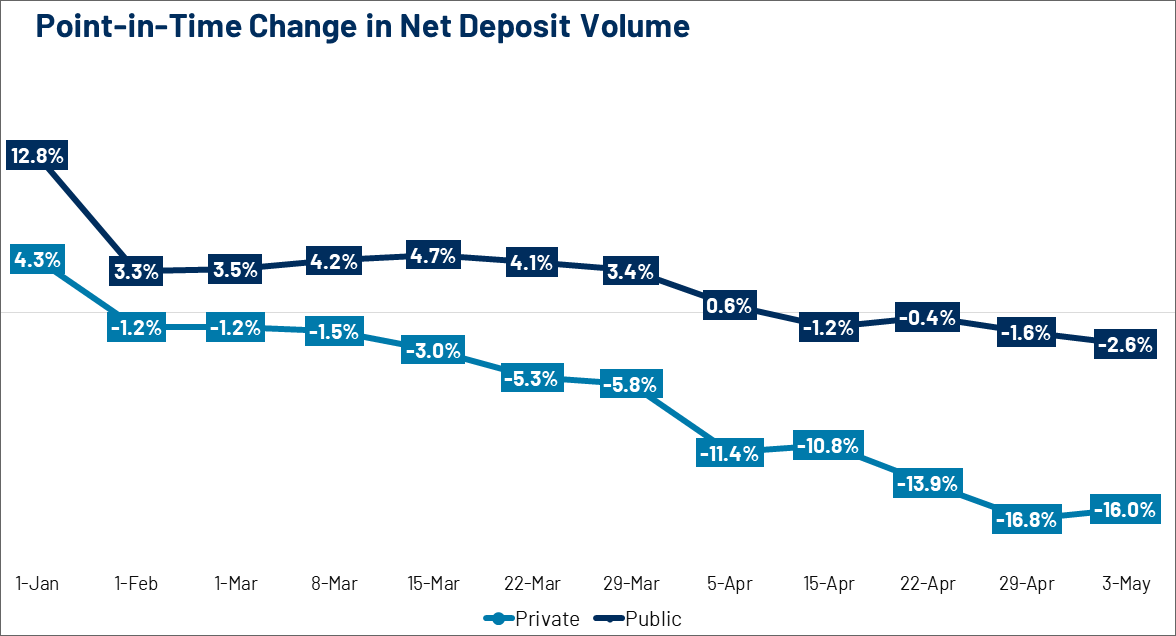

MARKETview’s Public and Private Cohorts came out of the gate strong in January with publics ahead 12.8% in net deposit volume and privates up 4.3%. Unfortunately, everything trended downward from that point. The Private Cohort (sitting at -16.0%) is certainly concerning.

We all expect these numbers to improve in the weeks to come due to deadline extensions and we will be sure to publish follow-up posts as the narrative unfolds.

Storyline 3: The Importance of Deadlines

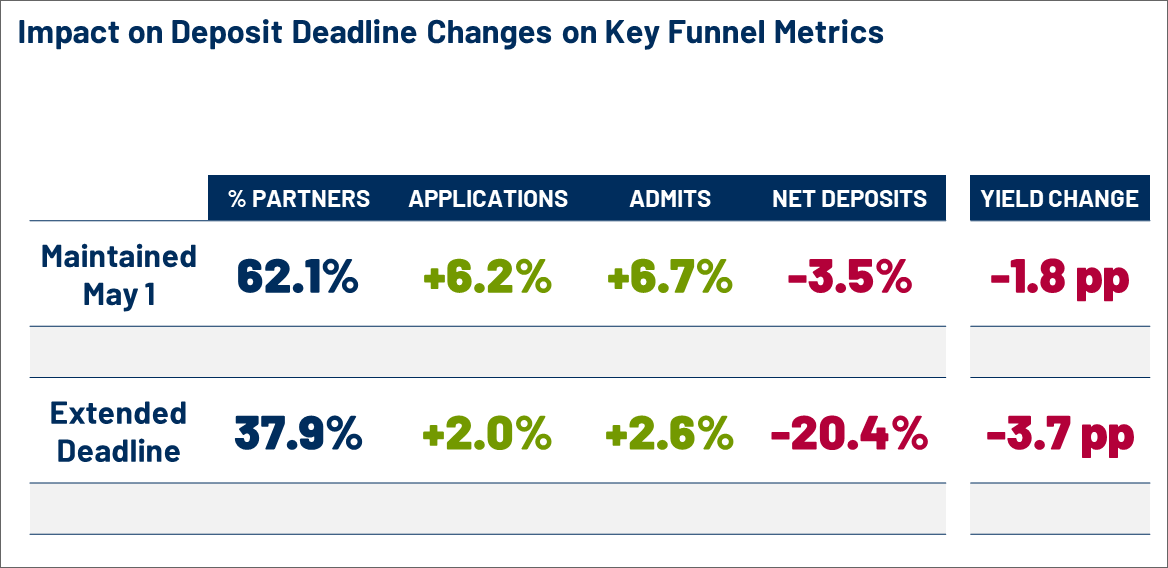

Any good marketer will tell you that deadlines spur action, and that’s certainly the case with student deposit behavior. Separating MARKETview partners by those that extended deadlines and those that did not makes this point clear.

As of May 3, schools that extended are down 20.4% while institutions that maintained the May 1 deadline (many of which have now extended their deadlines) are down a less daunting 3.5%. Neither of those outcomes is ideal, so the only real takeaway here is that deadlines drive people to act.

However, the deadline story is still unfolding…

Storyline 4: Narrowing the Gap

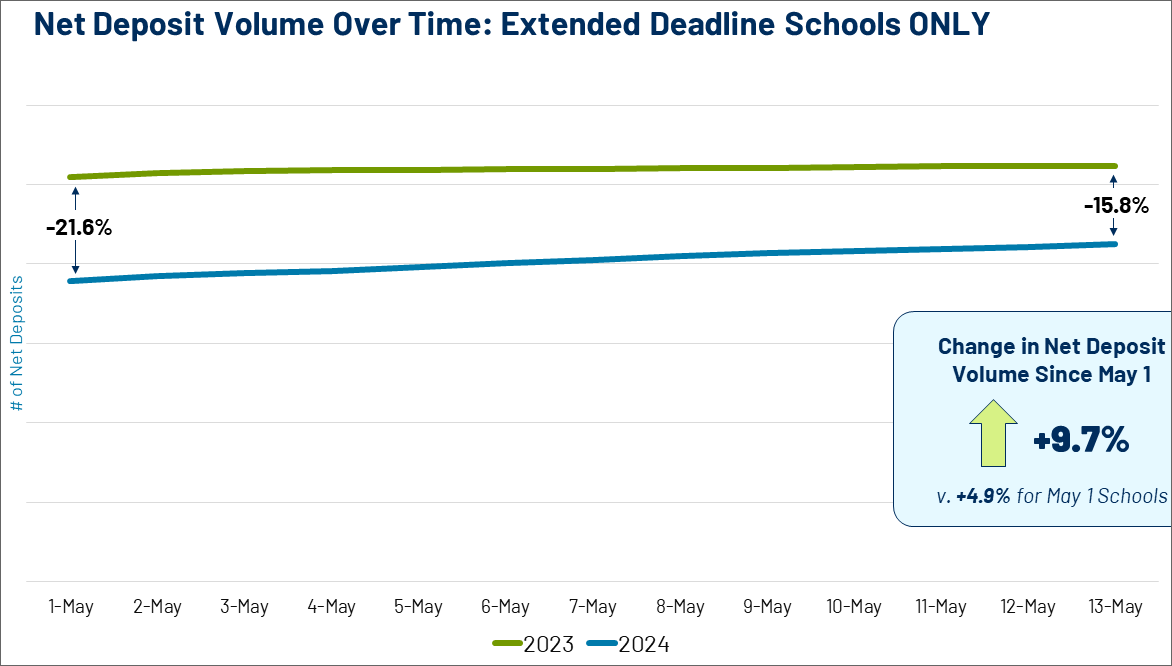

To close out on an uplifting note, as of May 13, the colleges and universities that extended their deadlines are closing the yield gap with a +9.7% change in net deposit volume since May 1 (versus +4.9% for schools that maintained a May 1 deadline).

This activity is encouraging, and we look forward to closely monitoring these trends – and providing updates – as we approach June 1. Once again, if you would like more detailed breakouts on deposit behavior post May 1, we invite you to view the webinar recording.

We know this has been an incredibly challenging yield season and we wish you all the best in bringing in your 2024 class!