We are in the thick of application season, and the early read is strong. Application volume is up 12.1%, and that lift is visible across both our Private cohort (+10.1%) and Public cohort (+23.0%). While International applicants (+36.2%) are driving up the overall volume, we also see a promising lift in applications (+11.3%) from domestic students.

As we pass major Early Decision and Early Action deadlines, application activity continues to stay strong.

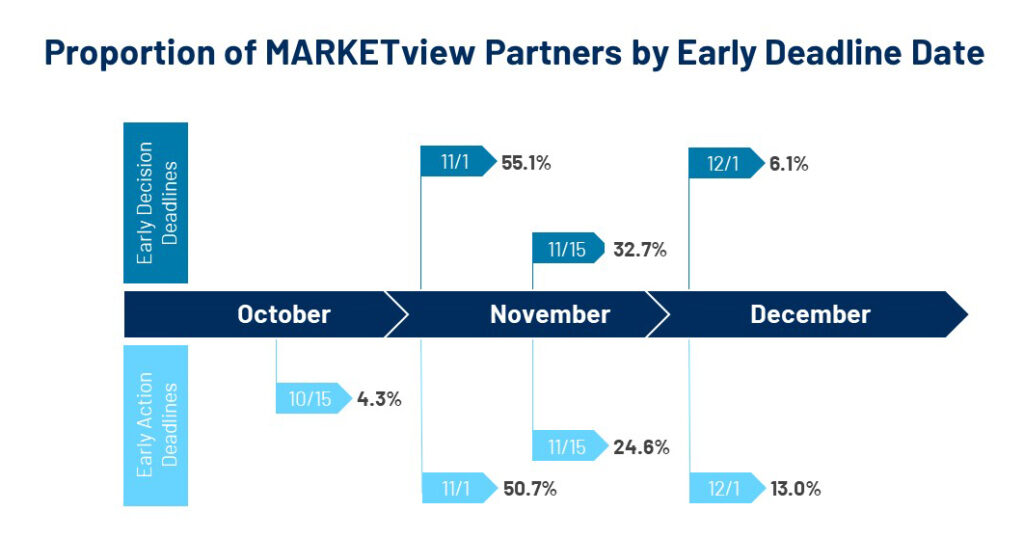

For context, 47.6% of our partners have an Early Decision round. Of those institutions with an Early Decision deadline, 55.1% promote November 1st as their first ED deadline, 32.7% promote November 15th, 6.1% promote December 1st, and the remaining 6.1% promote other dates as the deadline to apply Early Decision.

Among our partners, 67.0% have Early Action rounds. The majority (50.7%) leverage November 1 as the first deadline, but others promote October 15th (4.3%), November 15th (24.6%), December 1st (13.0%), or another date (7.4%).

Of course, not all institutions have an Early Decision or Early Action round. In fact, 26.2% of our partners are rolling admissions institutions. However, we know that even those schools without these early deadlines tend to benefit from a lift in applications during this stretch of time.

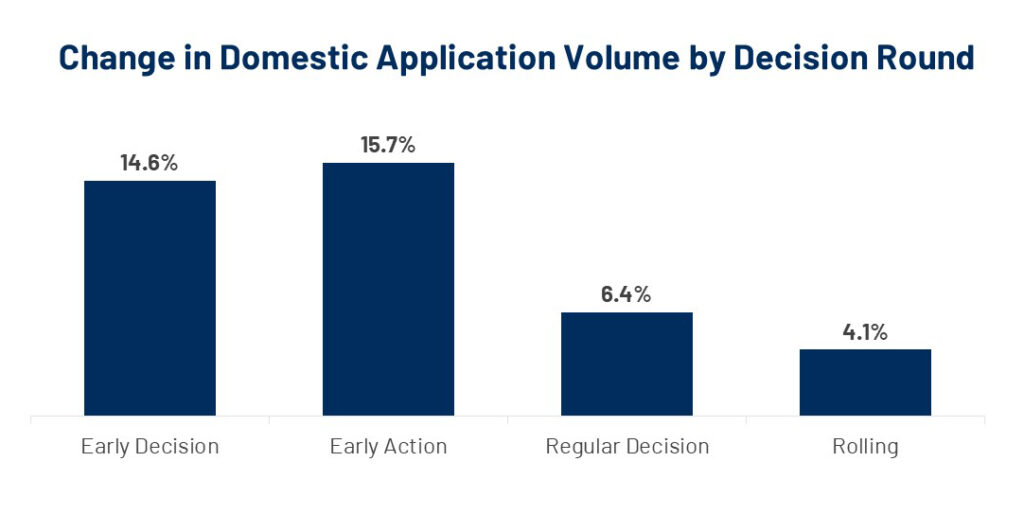

One of the biggest changes since the pandemic is the growth in both Early Decision and Early Action rounds. The story, so far, is continuing across MARKETview partners, with Early Decision and Early Action domestic application volume up 14.6% and 15.7%, respectively. While not as great of volume growth, Regular Decision and Rolling application volume is up year-over-year as well.

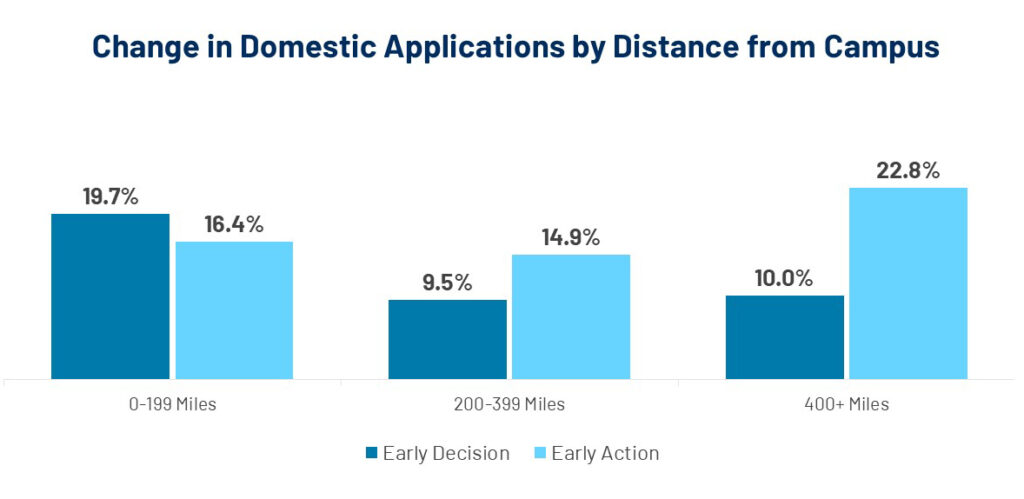

While there is growth across all distance bands, most of the Early Decision growth comes from within 200 miles of campus. Alternatively, the greatest growth in Early Action is from students who live beyond 400 miles from campus.

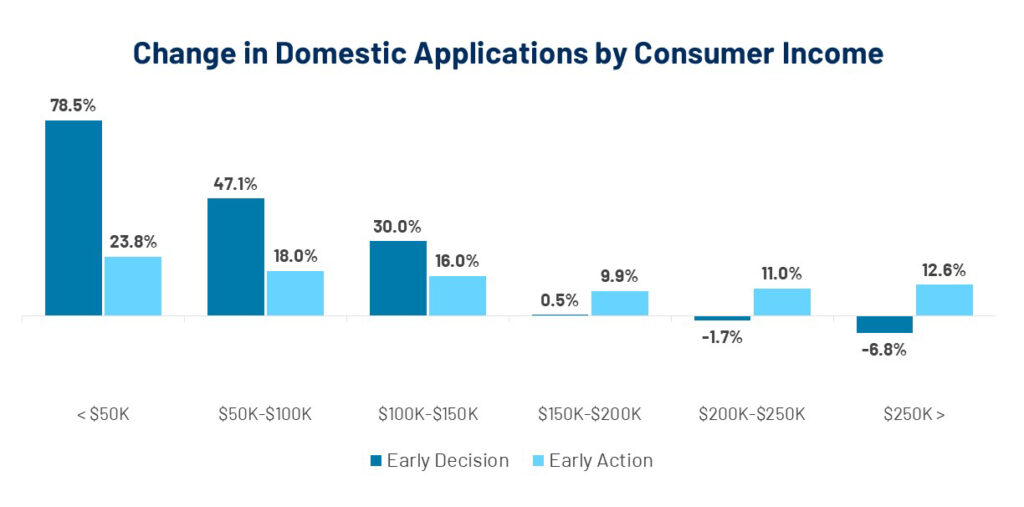

The socioeconomic profile of the Early Decision pool is changing. MARKETview’s household-level consumer income data indicates a 78.5% growth in Early Decision applications from students who live in households making less than $50,000 annually. Many of our partners have goals to increase socioeconomic diversity, but most also need affluence in the pool to make that growth possible. So, it is concerning that application volume is down from the most affluent students (households earning more than $200,000 annually).

This household income data is helping our partners pull forward their understanding of the financial profile of each student in their applicant pool, which is especially useful in this cycle given the delayed launch of the FAFSA (Free Application for Federal Student Aid).

We hope to share more insights with you in our upcoming webinar at 3:00 pm EDT on December 6. Register today.

Application Season Contextualized: A Real-Time Report on Early Applicant Behavior

Join us on December 6 at 3:00pm EDT to see MARKETview’s latest analysis on how, when, and where students have been applying throughout the fall – and what that indicates for application and deposit activity going forward.

Register Now