Welcome to the second of three installments covering how the growing number of disrupting factors within higher education are affecting the industry overall and, particularly, the Entering Class of 2024.

Based on data from MARKETview’s inaugural Partner Survey Report, this post will focus on Financial Budgeting and Support. We’ll explore where recruitment budgets are increasing or decreasing, which channels are getting more funding, and how overall staffing has been impacted at colleges and universities.

Financial Budgeting and Support: Three Key Findings

Enrollment leaders have always had to deal with tight budgets, but these days the increased need to justify every dollar spent has become an even trickier balancing act. See how they’re navigating these financial challenges:

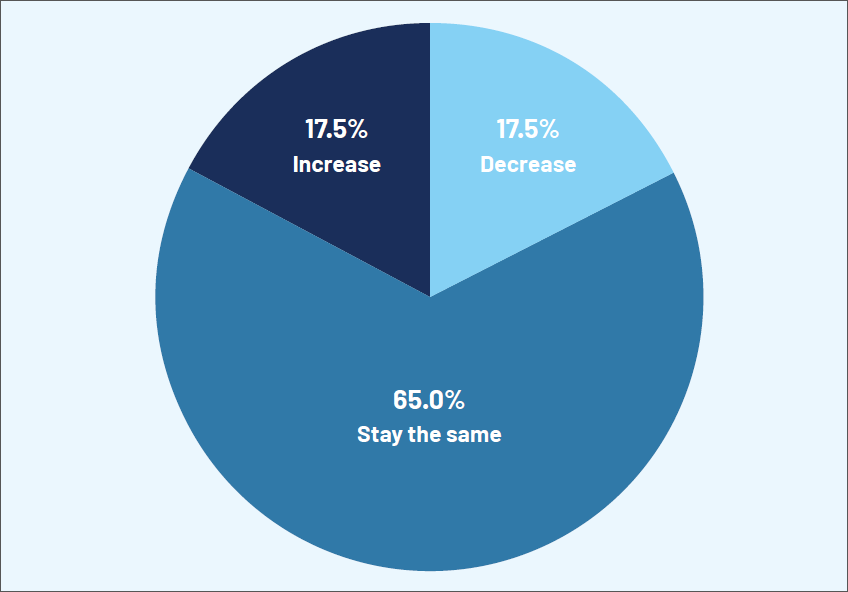

Q: For this upcoming cycle, will your overall budget increase, decrease, or stay the same?

Key Finding 1: Most recruitment budgets are not growing.

Purse strings are tight across college campuses as only 17.5% of institutions reported an increase in their recruitment and aid budget this year. Coincidentally, another 17.5% reported a decrease, while the other 65.0% of respondents have the same overall allotment as the previous year.

Since the preponderance of schools are dealing with stagnated or decreased funding, the importance of investing every dollar as wisely as possible has never been more critical.

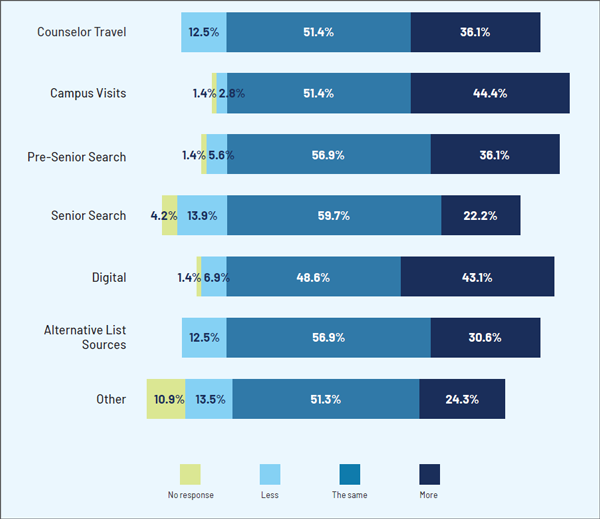

Q: Will you be spending more, less, or the same in each of these channels this cycle?

Key Finding 2: Campus visits and digital marketing are getting greater attention.

With more families willing to travel, funding for campus visits is rebounding with 44.4% of respondents getting an increase. Digital outreach is also strong with 43.1% schools slotted for additional monetary support.

Of note, a greater proportion of MARKETview partners (36.1%) are investing more in Pre-Senior Search than Senior Search programs (22.2%) in a likely effort to build relationships with students and families earlier in the process.

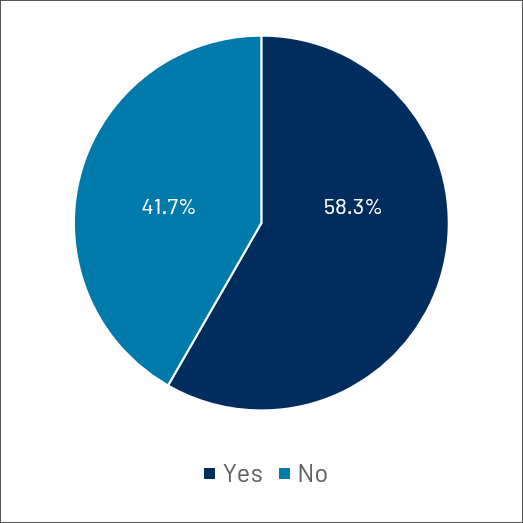

Q: Do you have open admission positions to fill?

Key Finding 3: Staffing shortages continue to hinder enrollment efforts.

It shouldn’t be unexpected that well over half of respondents indicated that they have open roles to fill. Plus, this number may be skewed by institutions that do not yet have approval to hire for needed positions. As this graphic represents, only 41.7% of respondents are fully staffed—perhaps an indication that the Great Resignation is not over yet.

For a deeper look into those institutions with open admissions positions to fill, 88.1% need to hire between 1–3 roles and 11.9% need to fill between 4–6, meaning many schools have a very pressing need for additional staff.

We hope you found this brief excerpt from part two of the MARKETview Partner Survey Report helpful in navigating the current challenges impacting higher education. Please be on the lookout for the final installment in the weeks ahead where we’ll continue to answer the question, “Is the enrollment profession at a crossroads?” in greater depth.

To see the full content of our survey right now, simply download the complete report.

2023 MARKETview Partner Survey

Access insights from the inaugural MARKETview partner survey. See insights on the effects of the the key disruptors affecting the higher education industry, including updates to the FAFSA, the recent Supreme Court ruling on affirmative action, test-optional policies, and more.

Download the Report