As colleges and universities hurtle toward their deposit deadlines (whether it’s May 1 or an extended date), uncertainty remains a key theme. With that in mind, MARKETview would like to share data on some of the biggest yield trends we’re seeing at this point across our partner base.

We hope these comparative views give you a better understanding of where your school stands within the larger market. All data are as of 4/8/24.

Trend #1: Private Institutions Are Being Affected the Most

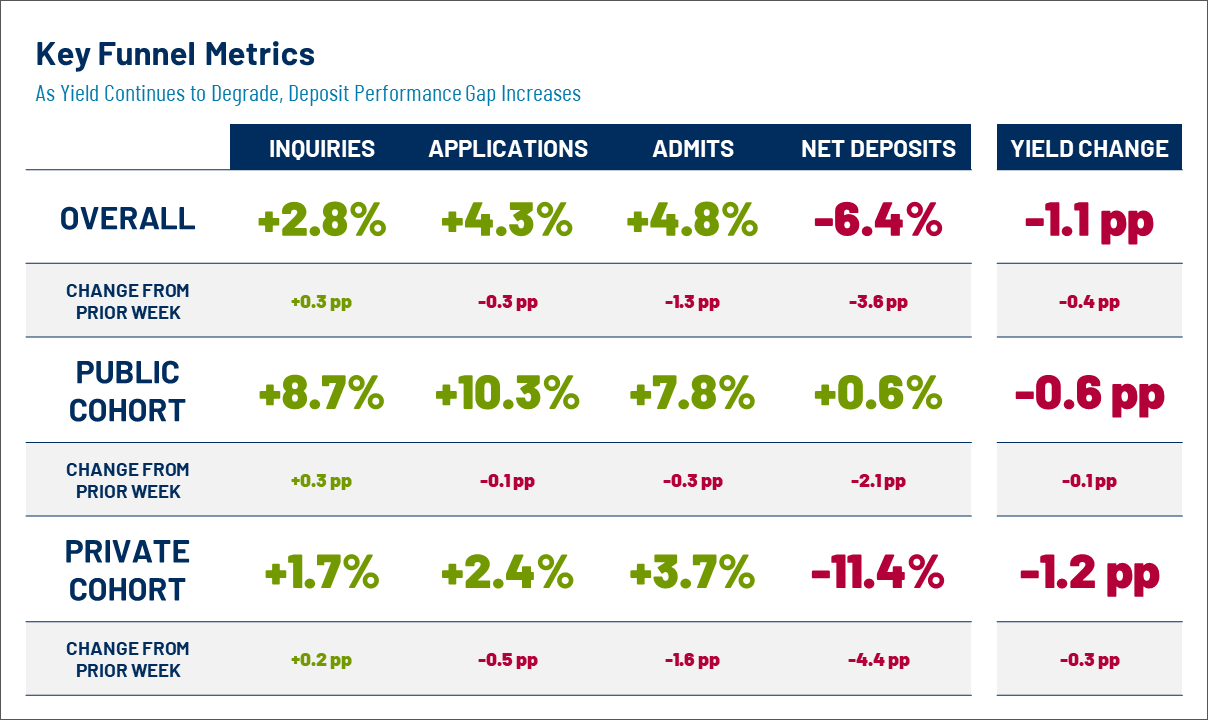

The graph below sheds light on several key metrics. Applications and admits have remained positive indicators compared the last year, but we’ve seen a steady slippage in yield that seems to be accelerating. Nowhere is that more apparent than with the Private Cohort.

Not only are privates down 11.4% in net deposits from last year, they’re also showing the biggest weekly drop from the previous week at -4.4 pp. Obviously, the week-to-week changes in yield will need to start trending upward for schools to achieve their enrollment goals.

Trend #2: Public Institutions Started Strong but Their Lead Is Shrinking

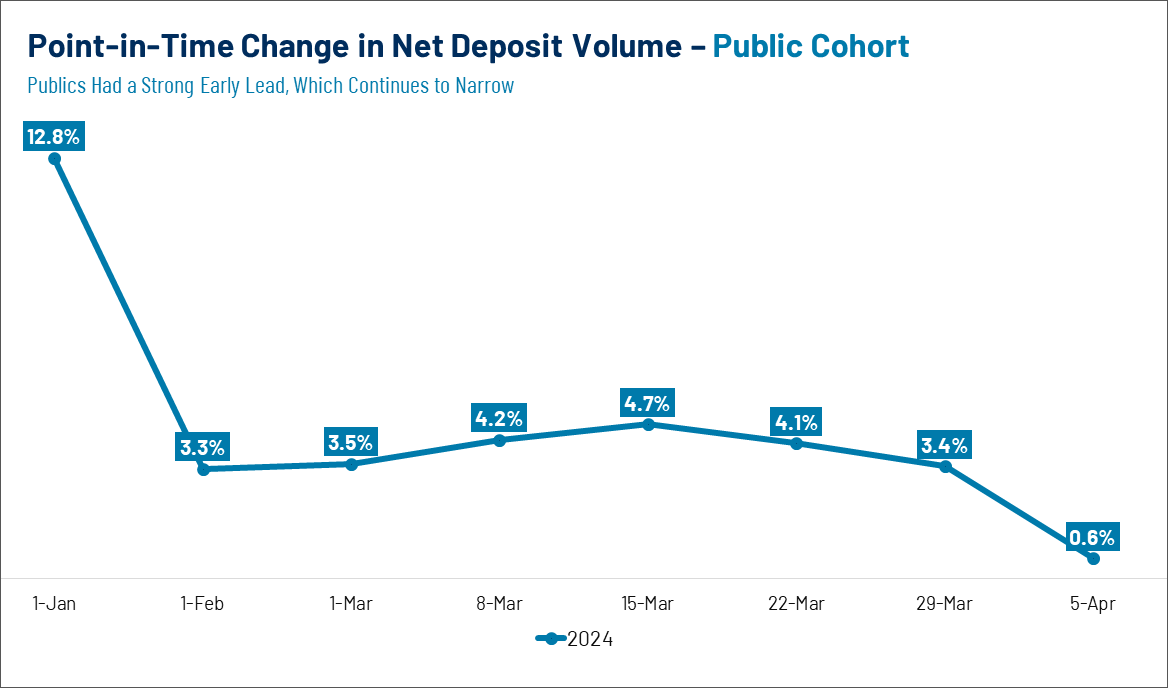

Looking at year-over-year net deposit volume by month, the Public Cohort started strong with net deposit volume up 12.8% in January before dipping to 3.3% in February. At that point, they experienced steady (but modest) growth into mid-March.

After that, however, they’ve been in decline with the latest data having them at just 0.6% ahead of last year. This downward trajectory may continue as families hold off on committing due to FAFSA delays.

Trend #3: Early Action Is Experiencing a Growth in Popularity

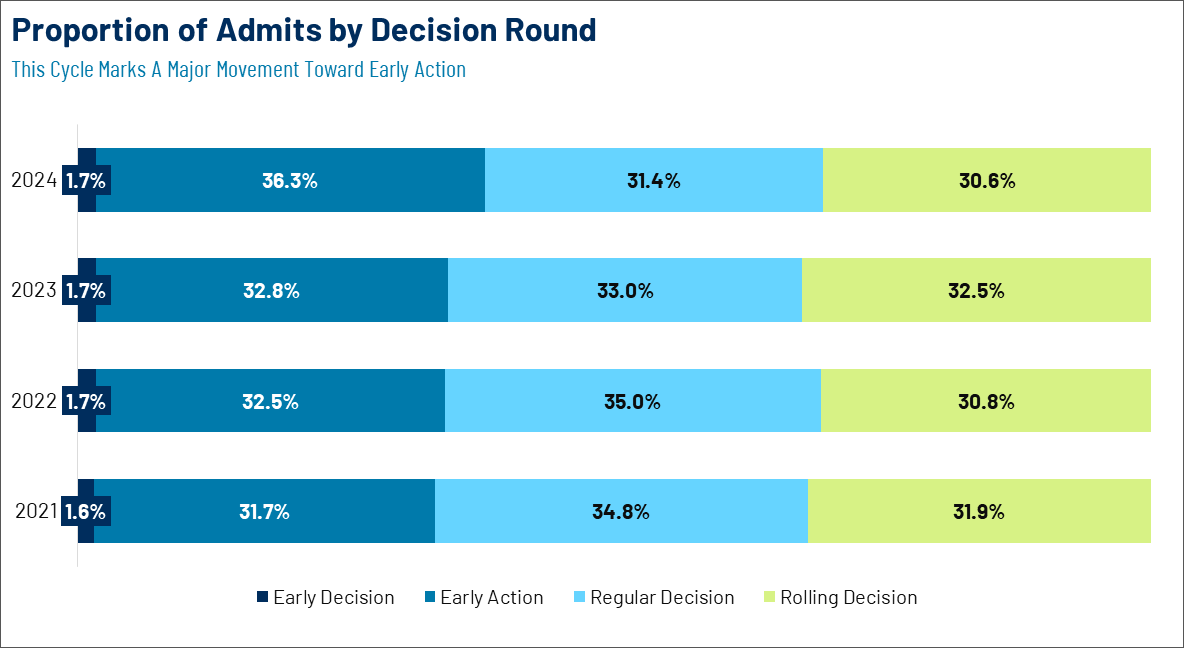

Switching gears, when we look at the distribution of admits by decision round, we can see that Early Action had been growing over the past few cycles and then it really popped up for 2024.

This noticeable change in preference toward Early Action is something we will be sure to monitor as, historically, Early Action admits have shown to be lower yielding. The increase could in fact be playing into the yield decline seen in previous slides.

Trend #4: Affluency Level Has No Bearing on Likelihood to Deposit

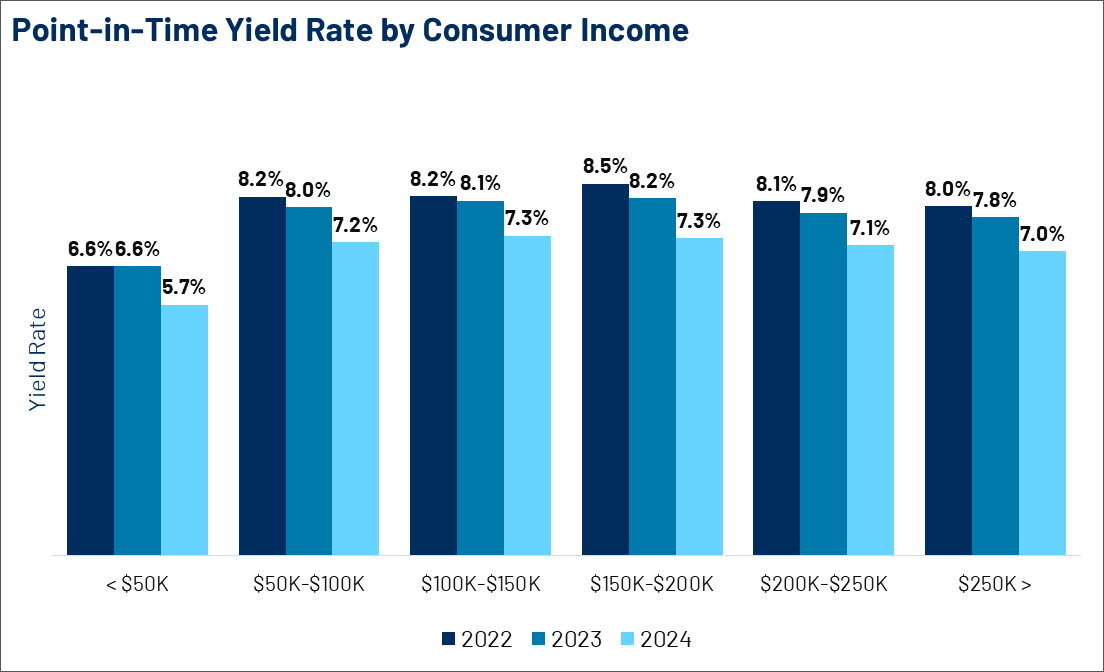

When it comes to consumer data, yield gaps exist in all income ranges and don’t vary much from group to group.

This slowness to deposit is important to consider as MARKETview’s consumer income band tells you a LOT about who’s going to qualify for need-based aid. Once again, we won’t begin to see the complete yield picture until families fully understand the true cost of attending.

Want to learn how MARKETview can provide your institution with comparative data you can use to achieve your enrollment and financial goals? Schedule a brief demo with us today.