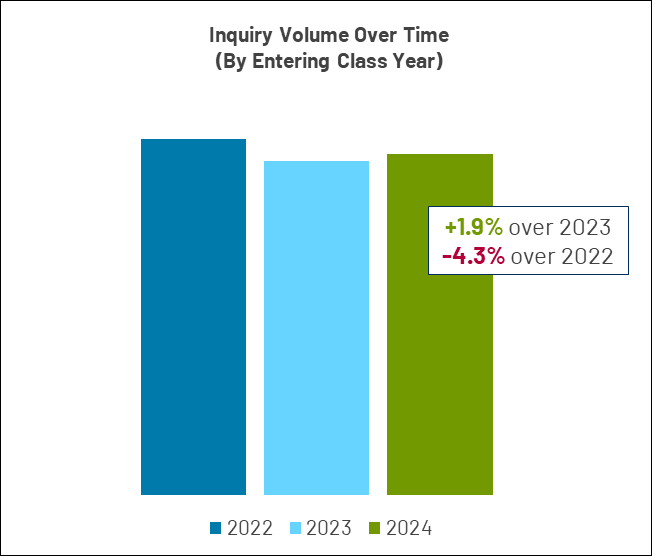

With the end of the summer quickly approaching, we are beginning to get an early look at how the Entering Class of 2024 is shaping up across the market. Overall, we’re seeing modest growth in inquiry volume across our partner base—with total inquiry volume up 1.9% over 2023, but still lagging 2022.

Below are three additional trends that we have observed for Entering Class of 2024 inquiries.

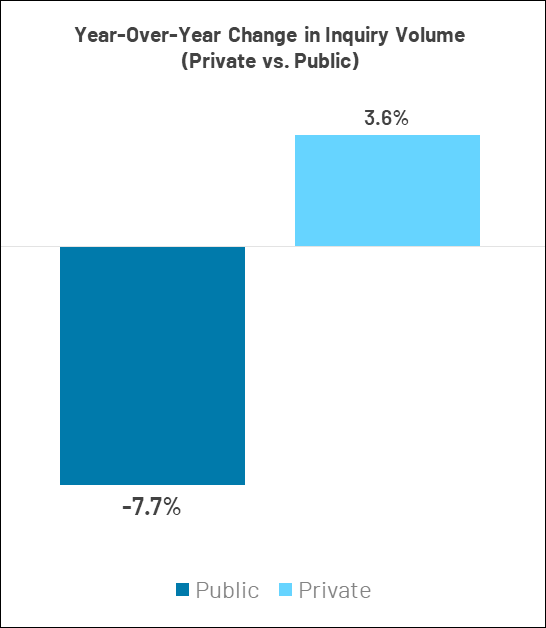

Growth in Inquiries Among Private Institutions, But Publics Are Trailing Year-Over-Year

Our private partner institutions are seeing greater growth, with 3.6% more inquiries point-in-time when compared to the Entering Class of 2023, while our public partners are down year-over-year, with 7.7% fewer inquiries.

The Timing of Student Engagement With Colleges Has Shifted

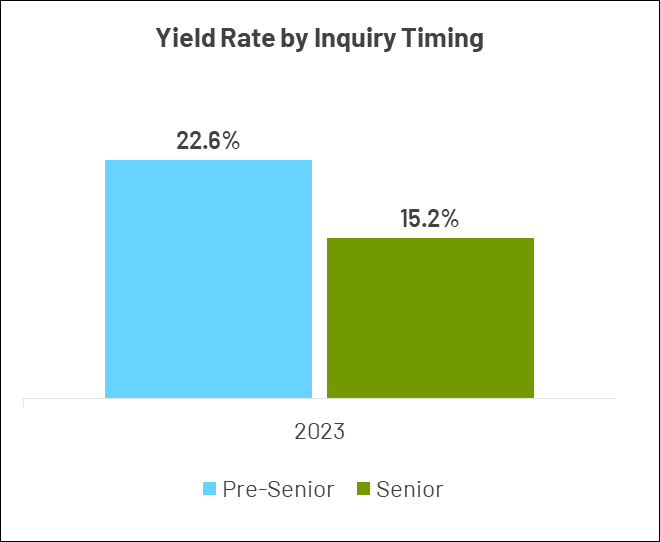

For context, we evaluate inquiries in MARKETview based on the timing of when they engage with a school. These students can be broadly sorted between two groups: those who first engage with a college before their senior year of high school and those who engage during their senior year of high school, including stealth applicants. Typically, pre-senior inquiries behave differently and have different characteristics than those students who inquire in their senior year.

Pre-senior inquiries yield significantly better across the market (22.6% yield rate across our partner base in 2023). Senior inquiries, on average, have a lower yield rate (15.2% in 2023).

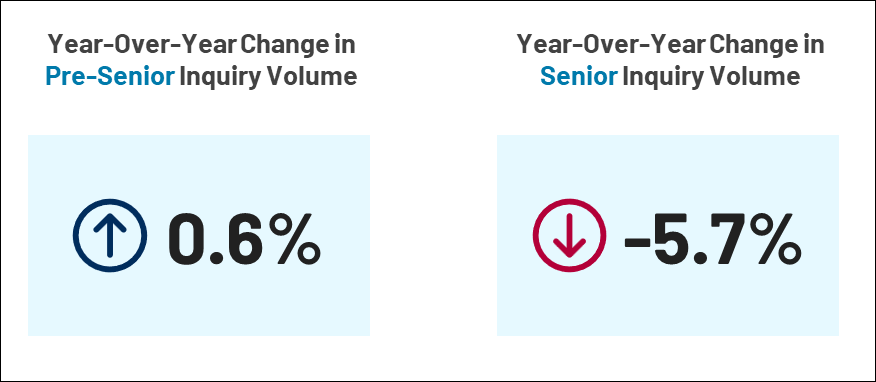

One of the lasting effects of COVID has been a change in when students first inquire, with a greater number of students waiting until their senior year of high school to raise their hand. For the Entering Class of 2024, we have seen little change in the volume of pre-senior inquiries, with a total growth of 0.6%. While it is promising to see that the volume of these inquiries has not decreased, we are 5.1% behind 2022 volumes and have not returned to pre-COVID behavior as it pertains to inquiry timing.

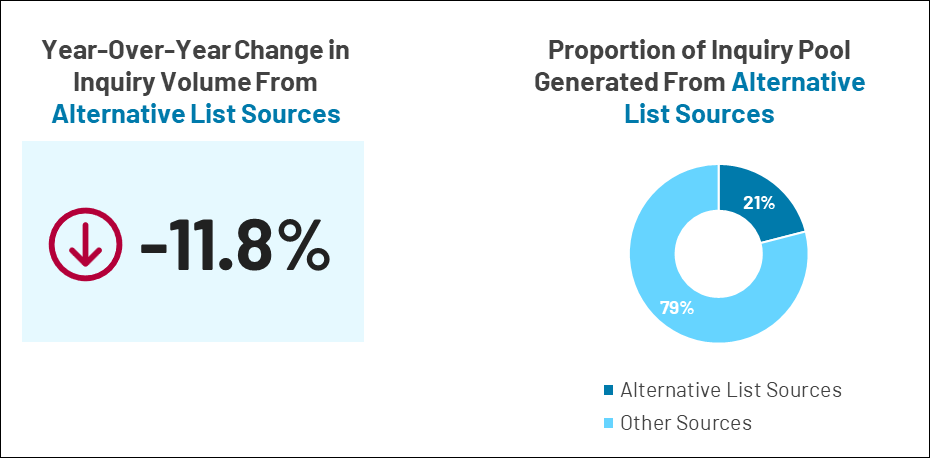

Inquiry Volume From Alternative List Sources

Finally, we are seeing some changes in how partners have built their inquiry pools. One of the ways we work with data at MARKETview is by standardizing inquiry sources, which allows us to have a comparative understanding of changes in how inquiries are sourced across the market.

For the Entering Class of 2024, we have seen a noticeable drop in the number of inquiries coming from alternative list sources—all list providers aside from the traditional test-based list sources.

While inquiry volume from these sources is down 11.8% year-over-year, these names are still driving 21% of all inquiry volume. This trend could indicate an intentional divestment from these sources, and we will continue to monitor the performance of these engagements throughout the cycle.