As a tumultuous calendar year for higher education comes to a close and colleges prepare for their much-deserved winter holiday breaks, MARKETview would like to share key insights on Early Applications as of December 1, 2023. In this post, we’ll discuss three trends we are seeing in our data set, and what they mean for application and deposit activity moving forward.

1. The Lead in Applications Has Narrowed Since November 1.

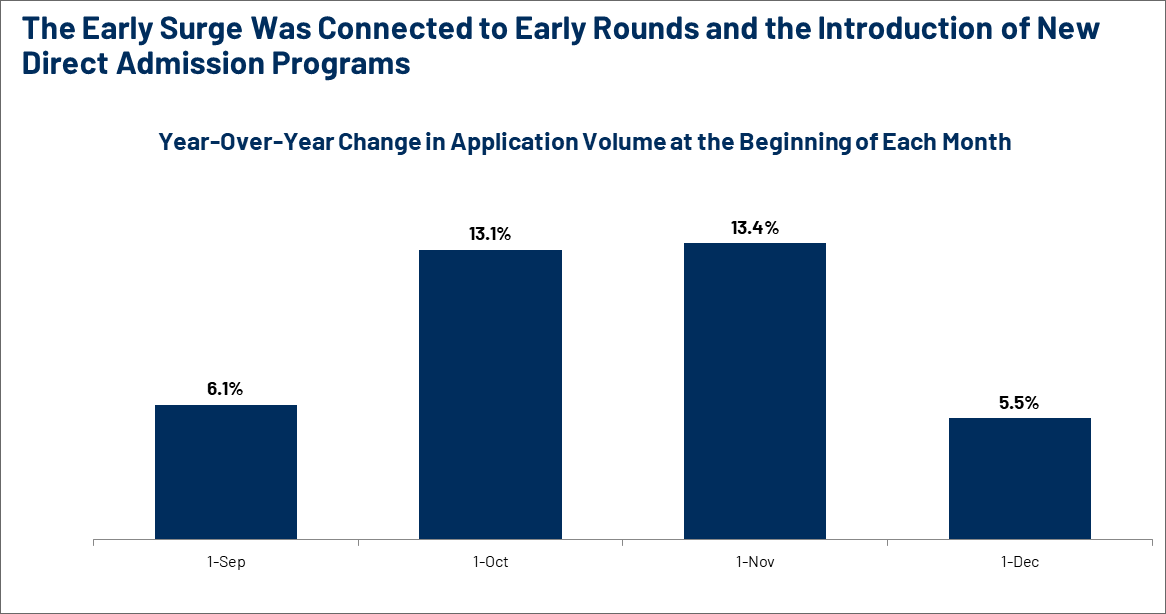

After a strong start to the application season with schools experiencing a 13.1% and 13.4% lift in year-over-year applications by October 1 and November 1, respectively, app volume is beginning to cool off. December 1 applications have narrowed to a 5.5% increase year-over-year.

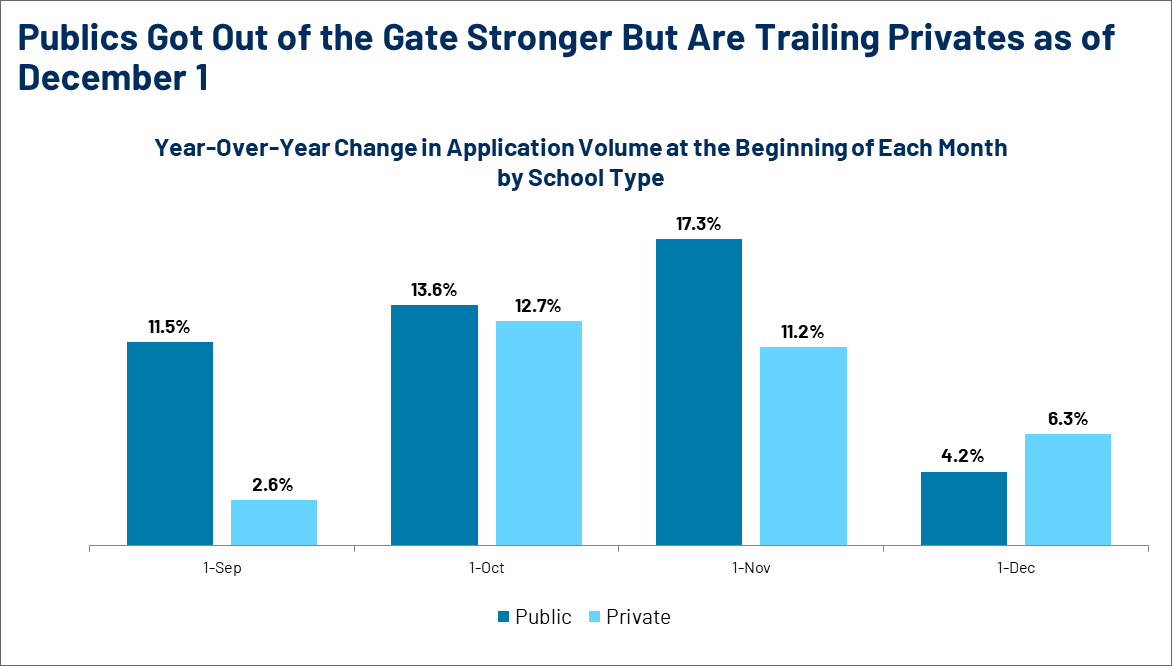

When we break down the data by school type, we see that both Private and Public applications have cooled in December. Publics dropped from their November 17.3% increase in year-over-year volume to a 4.2% increase in December. For the same period, Privates are down from their November 11.2% increase in year-over-year volume to just 6.3% more in December.

Initially, Publics had higher increases in year-over-year application volume from September to November but now trail Privates.

Application Season Contextualized: A Real-Time Report on Early Applicant Behavior

See MARKETview’s latest analysis on how, when, and where students have been applying throughout the fall – and what that indicates for application and deposit activity going forward.

View the Webinar

2. Application Growth is With Both Domestic and International Students

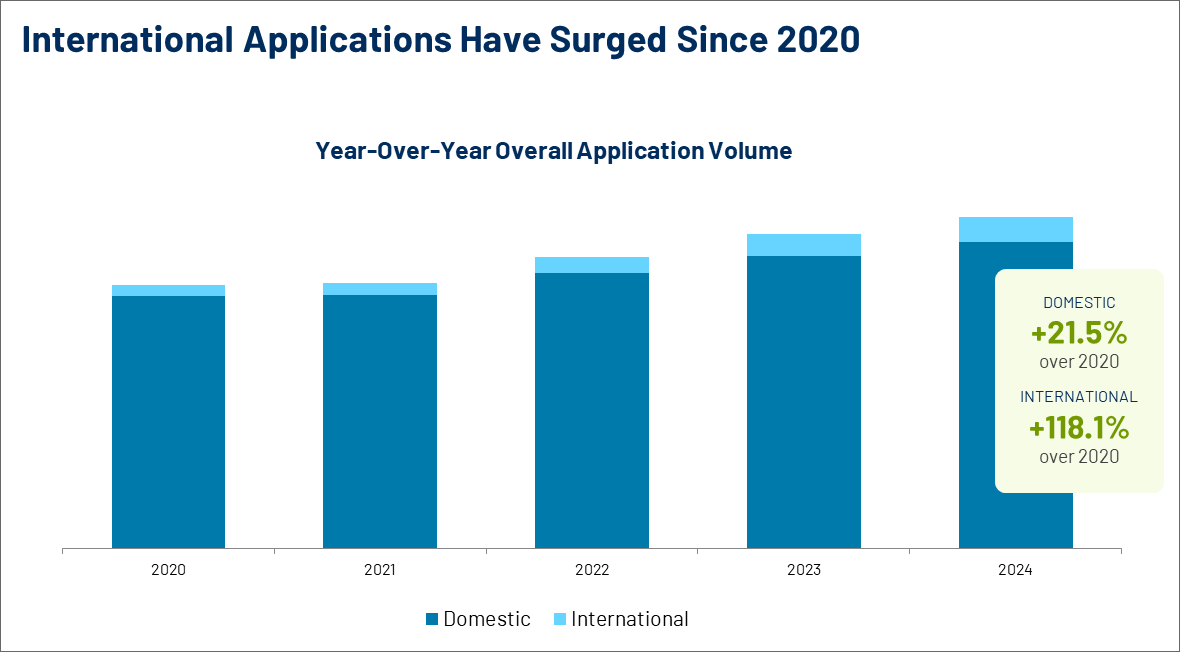

Despite international students representing a small overall population, application volume has soared—with an increase of 118.1% since 2020. Domestic student application volume is also on the rise with a 21.5% increase since 2020.

How the increase in international applications will translate to yield is another story. Many of these applications may not be admissible and of those that are, may not eventually yield if this year is anything like last. Despite an 18.1% increase in admit volume last year, international student net deposits remained flat throughout the cycle. We will be closely monitoring this population to see if this is the year that the increase in interest from international students ultimately translates to deposits.

3. The Greatest Year-Over-Year Lead is From Early Rounds

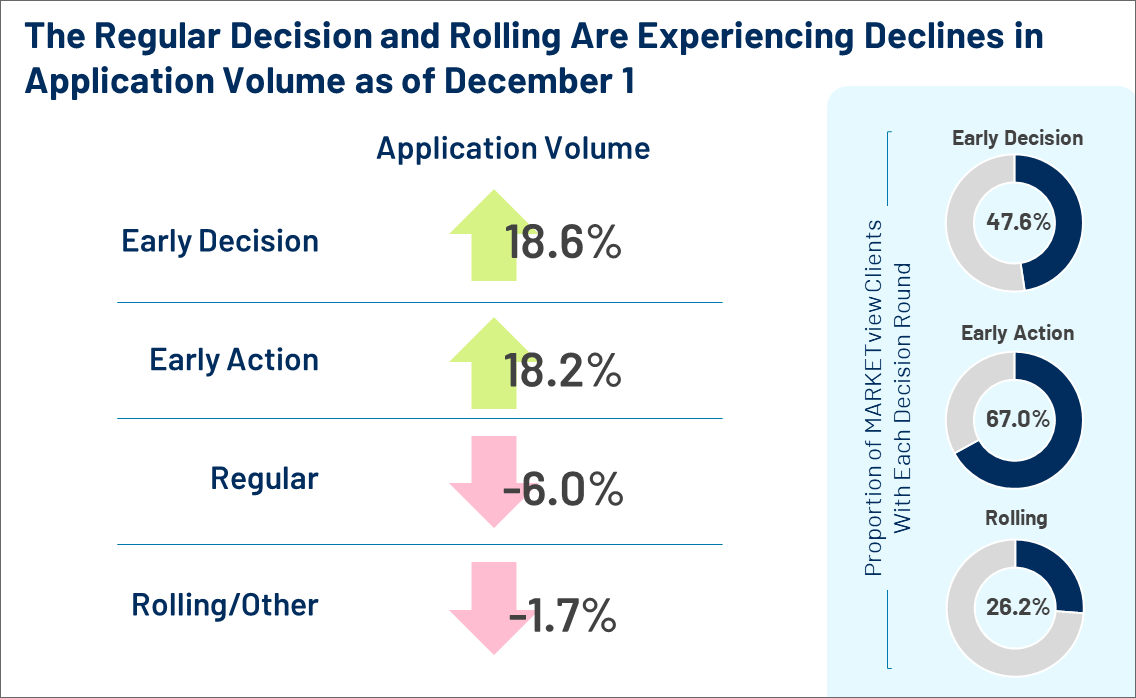

Application volume has risen very early in the cycle due to a large increase in early-round applications. Early Decision and Early Action are up 18.6% and 18.2% respectively. Conversely, the popularity of Regular and Rolling/Other admission types continues to decline.

Early Decision and Early Action applications aren’t just popular among students. Nearly half (47.6%) of MARKETview partners offer Early Decision applications and 67% of partners offer Early Action applications.

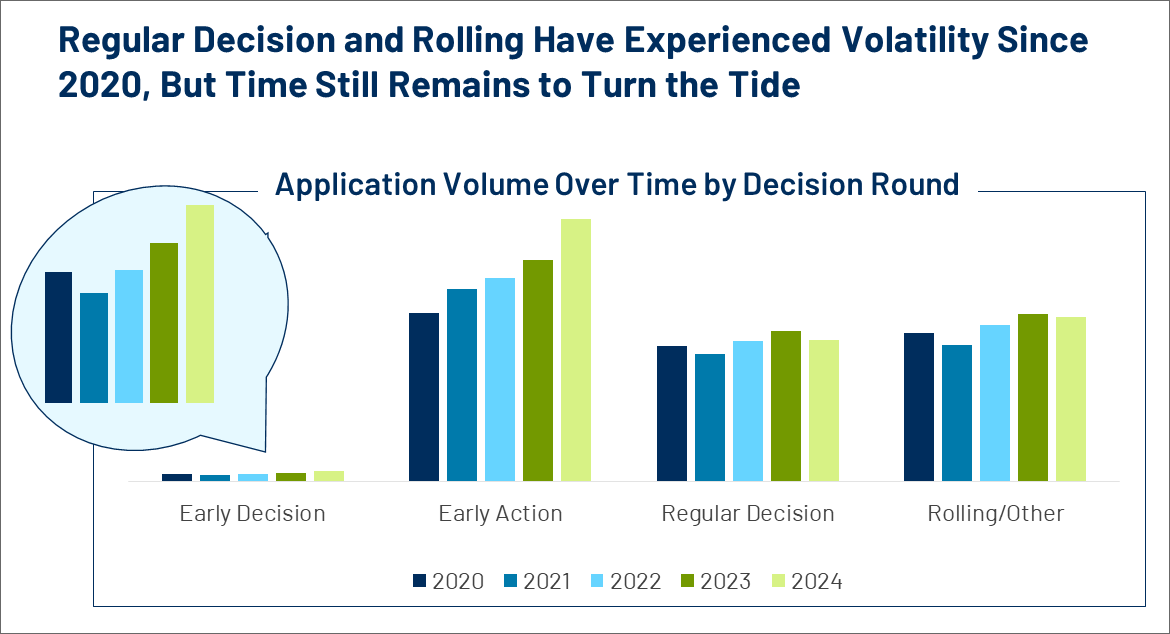

Students’ preference towards Early Decision and Early Action admission over Regular or Rolling/Other applications reflects a multi-year trend since 2020 with Early Action volume at the highest level we have ever seen this year.

We shared all these insights and more in a recent webinar: Application Season Contextualized: A Real-Time Report on Early Applicant Behavior.

View the recording to see a detailed analysis of these trends plus other findings from this cycle so far.

Application Season Contextualized: A Real-Time Report on Early Applicant Behavior

See MARKETview’s latest analysis on how, when, and where students have been applying throughout the fall – and what that indicates for application and deposit activity going forward.

View the Webinar