December’s ‘soft launch’ of the so-called ‘simplified’ FAFSA still leaves a lot of uncertainty for campuses and admitted students alike. The National Association of Financial Aid Administrators (NASFAA) has been working diligently to keep campus leaders informed while simultaneously advocating for greater transparency from our federal officials, including releasing an official statement addressing the challenges and confusion following the opening of the ‘24-’25 FAFSA. While their words of encouragement and their Student Aid Index (SAI) modeling tool provide some great guidance, many variables remain unaccounted for. These gaps along with a still evolving timeline leave a lack of appreciation for the impact the new FAFSA may have beyond a single campus.

Our work with several dozen campuses that partner with MARKETview for financial aid optimization and monitoring services provided the opportunity to shed more light on the effects across the broader market. Over the past few months, we used both the SAI modeling tool as well as our own proprietary household-level consumer data to analyze their Fall 2023 admitted students who filed a FAFSA.

Below are seven findings that are worth noting:

- 4% of the admitted student population lost Pell eligibility while 15% of the population gained Pell eligibility.

- Among those who maintained (or gained) eligibility, the average Pell grant increased by $1,341.

- 65% of students losing Pell eligibility were from families with multiple students in college.

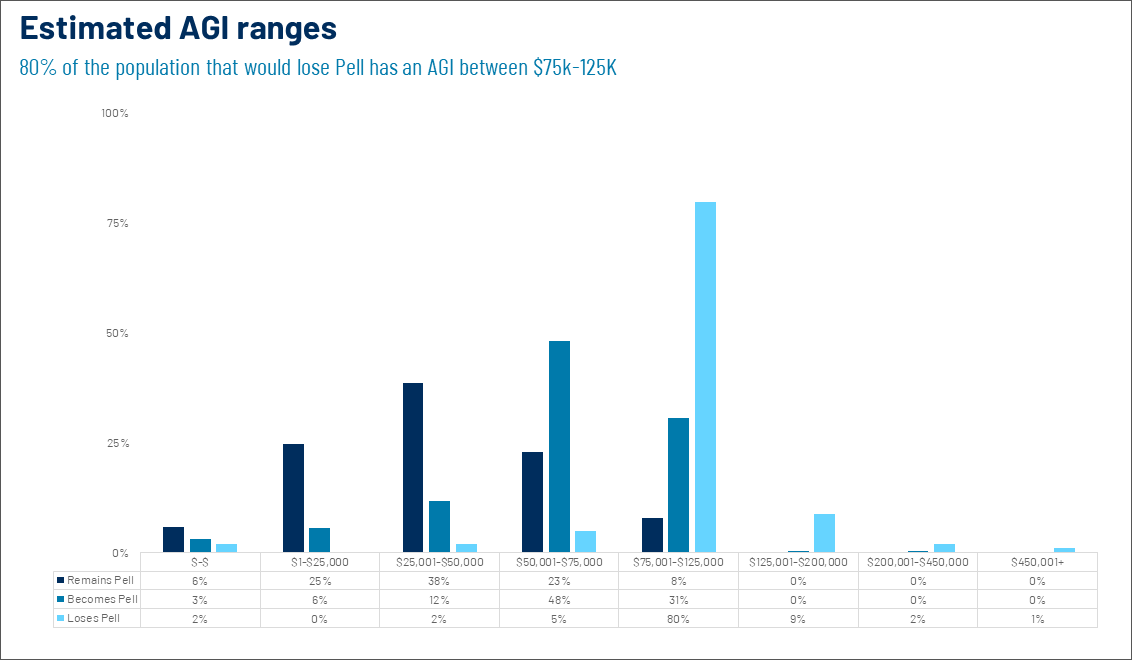

- The average household adjusted gross income (AGI) of a student losing Pell eligibility was $95,887.

- The average household AGI of a student who became Pell-eligible under the SAI parameters was $54,421.

- 80% of all changes in Pell Grant eligibility occurred within the $75,000 to $125,000 AGI range (see below).

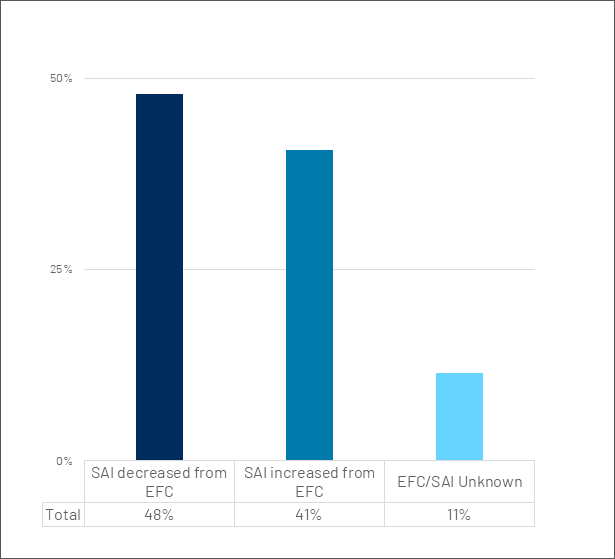

- 41% of families saw an increase in their SAI compared to their EFC. The average increase was $31,090 and was heavily driven by the new formula in the SAI that considers the number of students in a household enrolled in college when calculating awards (see below).

Proportion of Students With an Increase/Decrease in SAI

After a challenging “soft launch” on December 31st, the timeline for ISIR delivery remains ambiguous at best. However, when that moment arrives, we’re prepared to offer all MARKETview partners daily updates on FAFSA submission rates and trends.

While submission timing will certainly be different, understanding how your rate of aid applicants compares to competitors in the market will no doubt be a critical element for success as May 1 approaches.

Learn more about MARKETview’s Financial Aid Services or speak to one of our experts today.